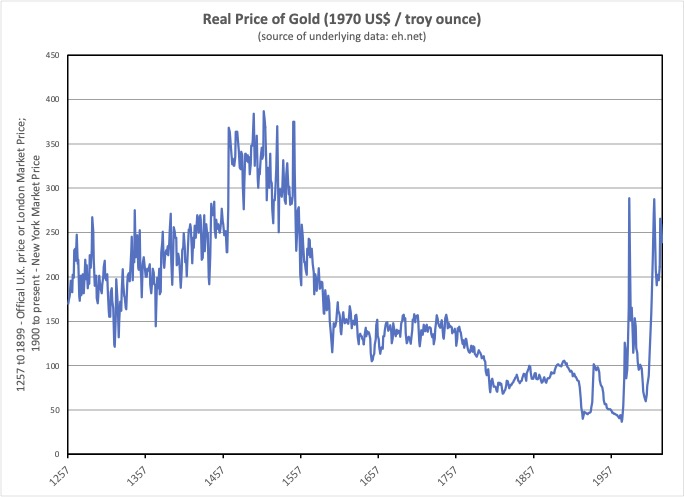

Gold is considered by many to be either an inflation hedge or an all-risk hedge. Yet, history — recent and long-term — shows that the real price of gold has fluctuated significantly, even violently in recent times. Here I show the real price of gold (the money price of gold divided by a consumer price index).

Prior to the discovery of the New World (and that the indigenous people of this hemisphere didn’t have guns), the real price of gold was gradually increasing. This might reflect that in between discoveries of gold, its real price tended to increase. Then, with the shipment to Europe of gold and silver from the New World, the real prices of these metals fell. This phenomenon is called the Price Revolution by historians.

Following the Price Revolution, the real price of gold was stable for about a hundred years. Then, during the 18th Century, the real price of gold started falling again. This period, during which the real price of gold fell from about 150 to about 100 percent of its 1970 value, has no special name. My guess as to the underlying cause of this decline in the real price of gold was the growth of fractional reserve banks, starting with the Bank of Amsterdam. Fractional reserve banks enabled a roughly constant supply of gold and/or silver to be multiplied into a larger supply of money.

Beginning in the 20th Century, following my shift of reference from London to New York, we see violent swings in the real price of gold. The first swing concerns the outbreak of WWI, and the suspension of the gold standard in Europe. The suspension of the gold standard in Europe resulted in gold flowing to New York, increasing the supply of gold in the US, and driving down its real price.

The real price of gold recovered during the late 1920s upon resumption of the gold standard in Europe. Since the US was then on a gold standard, this rise in the real price of gold was associated with deflation of consumer prices, waves of bank failures, and the Great Depression.

Following WWII and the Bretton Woods Agreement, the real price of gold fell again. The Bretton Woods Agreement can be described as a gold exchange standard. Only the US dollar was directly tied to gold. Other currencies were tied to gold indirectly, by being fixed in their exchange rates to the US dollar. This agreement allowed an expansion of the worldwide money supply sufficient to avoid a post-war deflation.

In 1971, with the US embarking on a path of deficit spending, the Bretton Woods Agreement broke down. With the breakdown of the Bretton Woods Agreement, the US dollar “floated” against gold, meaning that its value sank against gold. The country then moved like the Titanic from iceberg to iceberg, in a bewildering series of ever worse cycles of inflation and recession. Then, Paul Volker came in and, at the cost of a severe recession, guided the Federal Reserve to a path of “non-inflationary economic growth.”

As the above chart shows, during the years immediately following the breakdown of the Bretton Woods Agreement, the real price of gold reached a level not seen since the Price Revolution. The demand for gold was fueled by ongoing inflation and fears of its acceleration. But, with the adoption of “non-inflation economic growth” by the Fed, those fears weren’t realized, and the real price of gold collapsed.

In recent years, a new source of uncertainty has been driving up demand for gold, and its real price. In 2020, the Trump Administration asked Congress for trillions of dollars to slow the spread of COVID. Since then, the Biden Administration has followed suit with additional trillions of dollars of deficit spending.

Again the real price of gold has risen to historic highs. The fear fueling this increase in the demand for gold is that the “unsinkable” ship of state has been so compromised by debt that it now risks slipping under the waves.

One possible prospect is for the US to suffer decades of high rates of inflation such as characterized Argentina under Juan and Eva Peron and their successors.

Another possible prospect is for a crescendo of hyperinflation to utterly destroy the middle class and set the stage for a dictator such as happened in Germany during the 1920s.

With such possibilities, wouldn’t it be prudent to have some gold coins that you could sew into the lining of your coat, for when you must make your escape?

I will close with a story. As a high school student many years ago, I attended a national convention of young conservatives where I met an old lady. She said she was a youth in Russia at the time of the communist revolution there, but was fortunate to escape, going to Cuba. Then, as a mature adult, there was a communist revolution in Cuba. Again she was fortunate, this time escaping to the United States.

“You in America,” she said, “will not be fortunate. Because where can you go?”

0 Comments