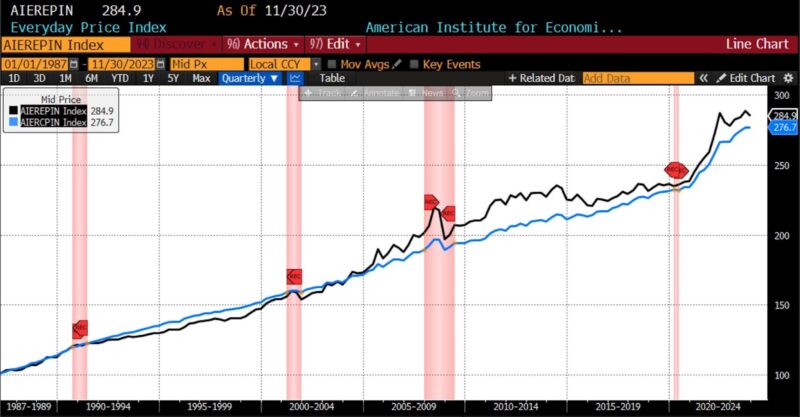

In November 2023, the AIER Everyday Price Index (EPI) fell 0.79 percent to 284.9. This is the largest percentage decline in the index in 2023, and the third-largest since the start of 2022.

AIER Everyday Price Index vs. US Consumer Price Index (NSA, 1987 = 100)

(Source: Bloomberg Finance, LP)

Within the EPI, the largest monthly increases among constituents came in several unexpected categories: admissions to movies, theaters, and concerts, tobacco and smoking products, and gardening and lawn care services. The most sizable declines came in motor fuel, as well as audio discs, tapes, and the purchase, subscription, and rental of video categories. In the month between October and November 2023, the prices of eleven EPI components rose, one was unchanged, and twelve declined.

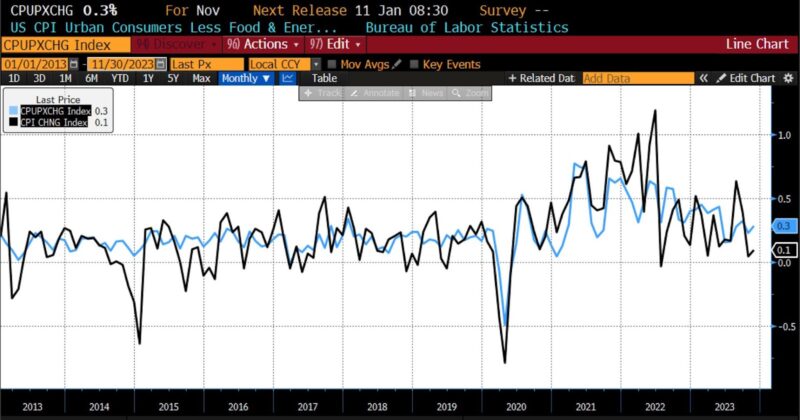

On November 14th the US Bureau of Labor Statistics (BLS) released Consumer Price Index (CPI) data for November 2023. The month-to-month headline CPI number rose 0.1 percent, exceeding surveys expecting no change (0.0 percent). The core month-to-month CPI number rose 0.3 percent, as surveys anticipated.

November 2023 US CPI headline & core month-over-month (2013 – present)

(Source: Bloomberg Finance, LP)

Within the November CPI, on a month-to-month basis, the largest increases were in rent, owners’ equivalent rent, medical care, and motor vehicle insurance. Household furnishings and operations, communication, and recreation saw the largest price declines from October to November.

From November 2022 to November 2023, headline CPI rose 3.1 percent, which met expectations and was down 0.1 percent from the previous month. Core CPI year-over-year rose 4.0 percent, which also met survey expectations and was unchanged from the prior month. Among the largest contributors to the year-over-year November headline were food away from home and cereal and bakery products, with gasoline and natural gas showing substantial declines of late. Among core year-over-year items in November, the greatest increases were seen in shelter as well as used cars and trucks (ending a five month string of consecutive price declines). Prices fell notably in lodging away from home, apparel, and home furnishings from November 2022 to November 2023.

November 2023 US CPI headline & core year-over-year (2013 – present)

(Source: Bloomberg Finance, LP)

Over the past month, a substantial amount of commentary has revolved around the likely start of interest rate cuts in 2024. In light of both the November 2023 inflation data and the growing consensus of a US soft landing versus a recession, this seems premature. Core prices rose at a 3.4 percent annualized basis (compounded), which is still substantially higher than the Fed’s current target rate range. While the likelihood of another rate hike in the final FOMC meeting of 2023 this week is low, the slowing rate of disinflation and stubbornly elevated prices in certain key goods and services, most notably shelter prices, suggest that speculation regarding the start of rate cuts is, at best, early.

0 Comments