Summary

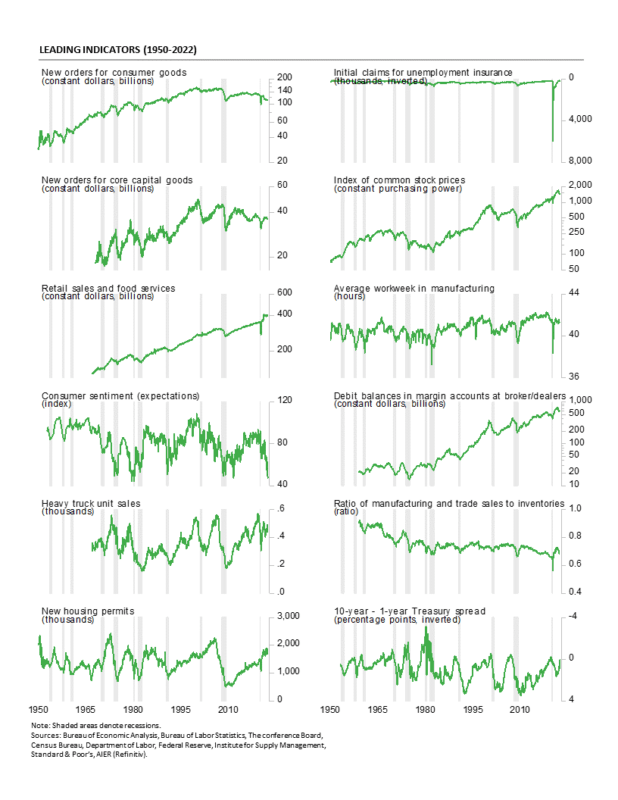

AIER’s Leading Indicators Index fell back below the neutral 50 threshold in June, dropping eight points to a reading of 42, and the lowest level since August 2020. Despite the new cycle low, the Leading Indicators Index continues to fluctuate around the neutral 50 threshold, with the average over the last nine months coming in at exactly 50 (see chart). Over the last nine months, the Leading Indicators index has been above neutral twice, below neutral three times, and exactly neutral four times. Any additional declines that take the leading index farther below the current 42 reading would suggest a significantly higher risk of recession.

Persistently elevated rates of price increases and an intensifying Fed tightening cycle are impacting economic activity. Consumer attitudes and consumer spending are flashing warning signs while higher mortgage rates are weighing on housing. However, the strong labor market continues to provide support for consumer incomes. The outlook remains highly uncertain. Caution is warranted.

AIER Leading Indicators Index Falls to 42 in June

The AIER Leading Indicators index posted a decline in June, dropping eight points to 42. Over the last nine months, the Leading Indicators index has been above neutral twice, below neutral three times, and exactly neutral four times, with the average over that period coming in exactly neutral at 50. Any additional declines that take the leading index farther below the current 42 reading would suggest a significantly higher risk of recession.

Two leading indicators changed signal in June. The real new orders for consumer goods indicator weakened to a negative trend from a neutral trend just one month after turning from a negative trend to neutral. Frequent shifts in trend suggest the indicator may be in a transition phase. Trends in this indicator, along with the real retail sales indicator, may be critical over coming months.

The trend in the real retail sales indicator has been improving recently. Over the first six months of 2022, the real retail sales indicator was trending lower in January and February, trending flat in March and April, and trending higher in May and June. However, over the last six months, actual real retail sales have posted monthly gains in three months (January, February, and April) and declines in three months, including a 1.3 percent drop in May. The next few months may be critical.

Housing permits weakened from a positive trend to a neutral trend in June. Given the sharp rise in mortgage rates and elevated home prices, this is not a surprising development. Other housing-related data point to softening activity as well.

Among the 12 leading indicators, four were in a positive trend in June while six were trending lower and two were trending flat or neutral.

The Roughly Coincident Indicators index posted a second consecutive decline in June, dropping to a reading of 75 from 83 in May, and a perfect 100 in April. One indicator weakened in June. The Conference Board Consumer Confidence in the Present Situation fell from a positive trend to a neutral trend. Most measures of consumer attitudes are weakening, primarily a result of persistent, elevated rates of price increase.

Overall, four indicators – nonfarm payrolls, employment-to-population ratio, industrial production, and real personal income excluding transfers were trending higher in June while the real manufacturing and trade sales indicator was in a negative trend and the Conference Board Consumer Confidence in the Present Situation was in a flat or neutral trend.

AIER’s Lagging Indicators index was unchanged for the fifth consecutive month, holding at 83 in June. February through June was the best five-month run since June through October 2018. No individual indicators changed trend for the month. In total, five indicators were in favorable trends, one indicator had an unfavorable trend, and none had a neutral trend.

Persistently elevated rates of price increase are weighing heavily on consumer attitudes and may be starting to impact spending patterns. Furthermore, they have pushed the Fed to intensify the current policy tightening cycle, raising the risk of a policy mistake. Meanwhile, the fallout from the Russian invasion of Ukraine continues to disrupt global supply chains, and ongoing labor shortages and turnover are challenging businesses, though there may be some early signs of easing on the labor front.

The outlook is for continued economic growth, but risks remain elevated. Consumer spending is facing strengthening headwinds from declining confidence while housing is showing some signs of fatigue as record home prices and surging mortgage rates temper demand.

Additionally, 2022 is a Congressional election year. Intensely bitter partisanship and a deeply divided populace could lead to turmoil as confidence in election results come under attack. Contested results around the country could lead to additional economic disruptions and government paralysis, again testing the durability of democracy. Caution is warranted.

Consumer Sentiment Plunged to a Record Low in June

The final June results from the University of Michigan Surveys of Consumers show overall consumer sentiment plunged to a new record low. The composite consumer sentiment index decreased to 50.0 in June, down from 58.4 in May, a loss of 8.4 points or 14.4 percent. The index is at a level that is consistent with prior recessions.

Both component indexes posted sharp declines. The current-economic-conditions index fell to 53.8 from 63.3 in May. That is a 9.5-point or 15.0 percent decrease for the month, leaving the index at a record low.

The second sub-index — that of consumer expectations, one of the AIER leading indicators — lost 7.7 points or 13.9 percent for the month, dropping to 47.5. The index is at its lowest level since May 1980.

According to the report, “Consumers across income, age, education, geographic region, political affiliation, stockholding and homeownership status all posted large declines. About 79% of consumers expected bad times in the year ahead for business conditions, the highest since 2009.”

The one-year inflation expectations was unchanged at 5.3 percent in June, just below the March and April 2022 level of 5.4 percent. The one-year expectations has spiked above 3.5 percent several times since 2005 only to fall back. The five-year inflation expectations ticked up to 3.1 percent in June. That result remains within the 25-year range of 2.2 percent to 3.5 percent.

According to the report, “Inflation continued to be of paramount concern to consumers; 47% of consumers blamed inflation for eroding their living standards, just one point shy of the all-time high last reached during the Great Recession. Since the preliminary sentiment reading in mid-June, the Federal Reserve raised interest rates by 75 basis points, exceeding the 50 basis point hike that had been previously telegraphed.”

The report adds, “Consumers also expressed the highest level of uncertainty over long-run inflation since 1991, continuing a sharp increase that began in 2021.”

The plunge in consumer attitudes reflects a confluence of events, with inflation leading the pack. Persistently elevated price increases affect consumer and business decision-making and distort economic activity. Overall, economic risks remain elevated due to the impact of inflation, an intensifying Fed tightening cycle, and disruptions associated with the Russian invasion of Ukraine and periodic lockdowns in China. As the midterm elections approach, negative political ads may also weigh on consumer sentiment.

Inflation Fears Continue to Drag Consumer Expectations Lower

The Consumer Confidence Index from The Conference Board fell again in June, the second drop in a row and seventh in the last twelve months. The composite index decreased 4.5 points or 4.4 percent to 98.7, the lowest level since February 2021. From a year ago, the index is down 23.4 percent. The decline was concentrated in consumer’s expectations for the future.

The expectations component sank 7.3 points, or 9.9 percent, to 66.4 while the present-situation component – one of AIER’s Roughly Coincident Indicators – fell just 0.3 points to 147.1. The expectations index is down 38.8 percent from a year ago and is at its lowest level since March 2013. The index is below the readings just before the start of three of the last four recessions.

Within the expectations index, all three components fell versus May. The index for expectations for higher income fell 2.0 points to 15.9 while the index for expectations for lower income rose 0.7 points, leaving the net (expected higher income – expected lower income) down 2.7 points to 0.7.

The index for expectations for better business conditions fell 1.7 points to 14.7 while the index for expected worse conditions rose 3.1 points, leaving the net (expected business conditions better – expected business conditions worse) down 4.8 points to -14.8.

The outlook for the jobs market weakened in June as the expectations for more jobs index fell 1.2 points to 16.3 while the expectations for fewer jobs index rose by 2.5 points to 22.0, putting the net down 3.7 points to -5.7.

For the present situation index components, current business conditions and employment conditions weakened slightly. The net reading for current business conditions (current business conditions good – current business conditions bad) was -3.4 in June, down from -1.9 in May. Current views for the labor market saw the jobs hard to get index decrease, falling 0.8 points to 11.6 as the jobs plentiful index fell 0.6 points to a still-strong 51.3 resulting in a 0.2-point gain in the net to 39.7. A net above 40 is considered strong by historical comparison.

Inflation expectations rose to 8.0 percent in June, a record high; expectations were 4.4 percent in January 2020. The sharp rise in expected inflation from The Conference Board survey is consistent with the University of Michigan survey results, though the magnitudes are different. Inflation expectations remain extremely high as prices for many goods and services continue to rise at an elevated pace. The extreme outlook for inflation is a key driver of weaker expectations among consumers.

Retail Sales Decline in May

Retail sales and food-services spending fell 0.3 percent in May following a 0.7 percent gain in April. From a year ago, retail sales are up 8.1 percent. Total nominal retail sales remain well above the pre-pandemic trend.

However, these data are not adjusted for price changes. In real terms, total retail sales were down 1.3 percent in May following a 1.0 percent increase in April and a 0.5 percent drop in March. From a year ago, real total retail sales are down 3.1 percent. As with nominal retail sales, real retail sales remain well above trend.

Core retail sales, which exclude motor vehicle dealers and gasoline retailers, rose 0.1 percent for the month following an 0.8 percent gain in April. The gains leave that measure with a 7.9 percent increase from a year ago.

After adjusting for price changes, real core retail sales fell 0.6 percent in May but are up 1.8 percent from a year ago. Real core retail sales are well above its prior trend.

Categories were mixed for the month with seven up and six down in May, on a nominal basis. The gains were led by gasoline spending, up 4.0 percent for the month. However, the average price for a gallon of gasoline was $4.70, up 7.5 percent from $4.37 in April, suggesting price changes more than accounted for the rise. Food and beverage store sales were up 1.2 percent in May while restaurants posted a 0.7 percent gain, and sporting goods, hobby, musical instrument, and bookstores sales were up 0.4 percent.

Among the decliners, automotive retailers had a 3.5 percent decrease in sales followed by electronics and appliance store sales (off 1.3 percent), miscellaneous store retailers (down 1.1 percent) and nonstore retailers (down 1.0 percent).

Overall, retail sales fell for the month and were dragged down by slower auto sales but remain well above trend. Excluding autos and gas, nominal core retail sales managed a small gain. However, rising prices are still providing a significant boost to the numbers. In real terms, total and core retail sales were down for the month. Furthermore, persistently elevated rates of price increase are starting to have a negative effect on consumer attitudes and may lead to a retrenchment in spending.

Existing Home Sales Fell to the Lowest Level Since June 2020

Sales of existing homes decreased 3.4 percent in May, to a 5.41 million seasonally adjusted annual rate. That is the fourth consecutive monthly decline, leaving the selling pace at the lowest level since June 2020 following the lockdown recession. Sales were down 8.6 percent from a year ago.

Sales in the market for existing single-family homes, which account for about 89 percent of total existing-home sales, dropped 3.6 percent in May, coming in at a 4.80 million seasonally adjusted annual rate. From a year ago, sales were down 7.7 percent. Single-family sales also fell for the fourth consecutive month and were at their slowest pace since June 2020.

The single-family segment saw sales decline in three of the four regions. Sales fell 6.0 percent in the West, 5.7 percent in the Midwest, and 2.7 percent in the South, the largest region by volume while sales were up 1.8 in the Northeast, the smallest region by volume. Measured from a year ago, sales were down in all four regions (-10.5 percent in the West, -9.5 percent in the Northeast, -7.2 percent in the Midwest, and -6.2 percent in the South).

Condo and co-op sales fell 1.6 percent for the month, leaving sales at a 610,000 annual rate versus 620,000 in April. From a year ago, condo and co-op sales were off 15.3 percent and were at their slowest pace since July 2020.

Condo and co-op sales were down in one region in May, falling 3.4 percent in the South and were unchanged in the other three regions. From a year ago, sales were down in all four regions (-22.6 percent in the South, -11.1 percent in the Midwest, -8.3 percent in the Northeast, and -6.7 percent in the West).

Total inventory of existing homes for sale rose in May, increasing by 12.6 percent to 1.16 million, leaving the months’ supply (inventory times 12 divided by the annual selling rate) up 0.4 months at 2.6, the highest since August 2021 but still low by historical comparison.

For the single-family segment, inventory was up 13.2 percent for the month at 1.03 million but is 1.0 percent below the May 2021 level. The months’ supply was 2.6, up from 2.2 in the prior month, the highest since September 2020.

The condo and co-op inventory increased 7.3 percent to 132,000, pushing the months’ supply up to 2.6 from 2.4 in April. Months’ supply is still 10.3 percent below May 2021 but has risen for four consecutive months.

The median sale price in May of an existing home was $407,600, 14.8 percent above the year ago price. For single-family existing home sales in May, the price was $414,200, a 14.6 percent rise over the past year and a record high. The median price for a condo/co-op was $355,700, 14.8 percent above May 2021 and also a record high. At the same time, mortgage rates have rocketed higher recently, reaching 5.78 percent by mid-June.

The combination of record-high home prices and sharply higher mortgage rates has sent housing affordability plunging. The Housing Affordability Index from the National Association of Realtors measures whether or not a typical family could qualify for a mortgage loan on a typical home. A typical home is defined as the national median-priced, existing single-family home as calculated by NAR. The typical family is defined as one earning the median family income as reported by the U.S. Bureau of the Census. A value of 100 means that a family with the median income has exactly enough income to qualify for a mortgage on a median-priced home. An index above 100 signifies that a family earning the median income has more than enough income to qualify for a mortgage loan on a median-priced home, assuming a 20% down payment. As of April, the index stood at 109.2, the lowest since July 2007.

Housing is likely to be under intense pressure as record-high prices and the recent surge in mortgage rates reduce affordability and push more and more buyers out of the market.

Home Construction Falls Again in May

Total housing starts fell to a 1.549 million annual rate in May from a 1.810 million pace in April, a 14.4 percent plunge. From a year ago, total starts are down 3.3 percent. Total housing permits also fell in May, posting a 7.0 percent drop to 1.695 million versus 1.823 million in April. Total permits are still up 0.2 percent from the May 2021 level.

Starts in the dominant single-family segment posted a rate of 1.051 million in May versus 1.157 million in April, a drop of 9.2 percent and are down 5.3 percent from a year ago. Single-family permits fell 5.5 percent to 1.048 million versus 1.109 million in April.

Starts of multifamily structures with five or more units decreased 26.8 percent to 469,000 and are off 3.3 percent over the past year while starts for the two- to four-family-unit segment jumped 141.7 percent to a 29,000-unit pace versus 12,000 in April. Combined, multifamily starts were off 23.7 percent to 498,000 in May and show a gain of 0.6 percent from a year ago.

Multifamily permits for the 5-or-more group fell 10.0 percent to 592,000 while permits for the two-to-four-unit category decreased 1.8 percent to 55,000. Combined, multifamily permits were 647,000, off 9.4 percent for the month but up 17.0 percent from a year ago.

Meanwhile, the National Association of Home Builders’ Housing Market Index, a measure of homebuilder sentiment, fell again in June, coming in at 67 versus 69 in May. That is the sixth consecutive drop and the lowest reading since June 2020. The index is down sharply from recent highs of 84 in December 2021 and 90 in November 2020. Rising mortgage rates, elevated home prices, and declining consumer sentiment are weakening demand while higher input costs, except for lumber, are a major concern for builders.

All three components of the Housing Market Index fell again in May. The expected single-family sales index dropped to 61 from 63 in the prior month, the current single-family sales index was down to 77 from 78 in May, and the traffic of prospective buyers index plunged again, hitting 48 from 53 in the prior month.

Input costs are still a concern for builders though lumber prices have declined sharply recently. Lumber recently traded around $560 per 1,000 board feet in mid-June, down from peaks around $1,700 in May 2021 and $1,500 in early March 2022. Other input materials such as copper were down slightly but still elevated with copper at $9,200 per metric ton. The high input costs will continue to pressure profits at builders.

Mortgage rates have rocketed higher recently, with the rate on a 30-year fixed rate mortgage coming in at 5.25 percent in mid-June, nearly double the lows in early 2021.

While the implementation of permanent remote working arrangements for some employees may have been providing continued support for housing demand, record-high home prices combined with the surge in mortgage rates and falling consumer attitudes are working to weaken demand. Pressure on housing demand combined with elevated input costs is sending homebuilder sentiment plunging. The outlook for housing is deteriorating rapidly.

New Single-Family Home Sales Bounce Higher in May

Sales of new single-family homes rose in May, rising 10.7 percent to 696,000 at a seasonally-adjusted annual rate from a 629,000 pace in April. The May gain follows a 12.0 percent decline in April, a 9.5 percent fall in March, a 4.9 percent fall in February, and a 1.0 percent drop in January. Despite the May gain, the four-month run of decreases leaves sales down 5.9 percent from the year-ago level. Meanwhile, 30-year fixed rate mortgages were 5.25 percent in late May, up sharply from a low of 2.65 percent in January 2021. Rates have continued to move higher in June, reaching 5.81 percent in late June, suggesting headwinds for housing continue to gain strength.

Sales of new single-family homes were up in two of the country’s four regions in May. Sales in the South, the largest by volume, rose 12.8 percent, while sales in the West surged 39.3 percent. However, sales in the Midwest decreased 18.3 percent, and sales in the Northeast, the smallest region by volume, plunged 51.1 percent for the month. Over the last 12 months, sales were down 42.5 percent in the Northeast and off 37.0 percent in the Midwest, but up 0.5 percent in the West and 1.5 percent in the South.

The median sales price of a new single-family home was $449,000, down from $454,700 in May (not seasonally adjusted). The gain from a year ago is 15.0 percent versus a 20.7 percent 12-month gain in April. On a 12-month average basis, the median single-family home price is still at a record high. The total inventory of new single-family homes for sale rose 1.6 percent to 444,000 in May, putting the months’ supply (inventory times 12 divided by the annual selling rate) at 7.7, down 7.2 percent from April but still 42.6 percent above the year-ago level. The months’ supply is very high by historical comparison. The high level of prices, elevated months’ supply, and surge in mortgage rates should weigh on housing activity in the coming months and quarters. However, the median time on the market for a new home remained very low in May, coming in at 2.4 months versus 3.1 in April.

0 Comments