Retail sales and food-services spending rose 0.3 percent in February following a 4.9 percent surge in January (see first chart). However, today’s retail sales data are not adjusted for price changes. In real terms, total retail sales were down 0.6 percent (adjusted using the CPI excluding shelter). Still, total retail sales are up 17.6 percent from a year ago while real retail sales are up 7.4 percent.

Core retail sales, which exclude motor vehicle dealers and gasoline retailers, fell 0.4 percent for the month, following a 5.2 percent jump in January (see first chart). The decline leaves that measure with a 15.8 percent gain from a year ago.

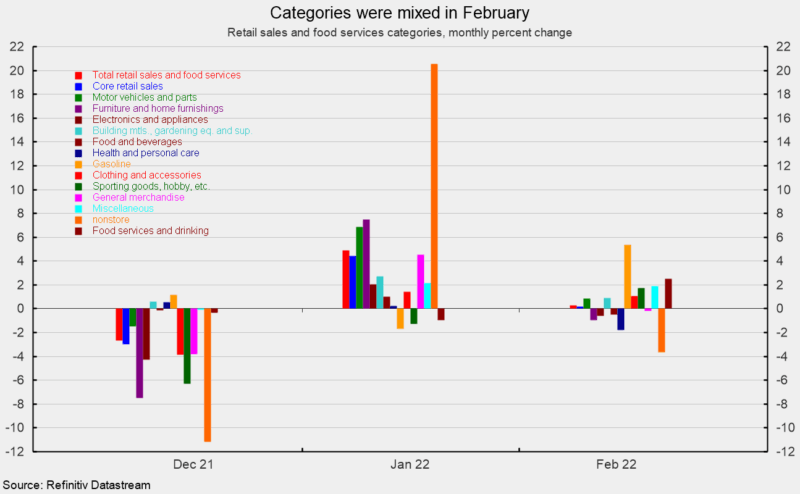

Categories were mixed for the month with seven up and six down in February. The gains were led by a 5.3 percent rise in gasoline spending. However, the average price for a gallon of gasoline was $3.68, up 5.0 percent from $3.50 in January. Food services and drinking sales followed with a 2.5 percent increase while miscellaneous store sales rose 1.9 percent and sporting goods, hobby, and bookstore sales gained 1.7 percent.

Nonstore retailers led the decliners, down 3.7 percent, followed by health and personal care store sales, down 1.8 percent, and furniture and home furnishings store sales, off 1.0 percent (see second chart).

Overall, total retail sales rose for the month, lifted by rising prices, especially for gasoline. However, in real terms, total retail sales fell. Furthermore, nominal core retail sales also posted a decline in February. Continuing labor shortages, along with materials shortages and logistical issues, are likely to continue to slow the recovery in production across the economy and sustain upward pressure on prices. In addition, geopolitical and global economic turmoil as a result of the Russian invasion of Ukraine has had a dramatic impact on capital and commodity markets, launching a new wave of disruptions to businesses. Additionally, an impending new Fed tightening cycle will further weigh on economic activity. The outlook has become highly uncertain.

0 Comments