New orders for durable goods decreased in February, falling 2.2 percent following a solid 1.6 percent gain in January and three additional gains from October through December. Total durable-goods orders are up 16.7 percent from a year ago. The February drop puts the level of total durable-goods orders at $271.5 billion, close to the record high (see first chart).

New orders for nondefense capital goods excluding aircraft or core capital goods, a proxy for business equipment investment, fell 0.3 percent in February after gaining 1.3 percent in January to a record high. Orders had risen for 11 consecutive months from March 2021 through January 2022 and 20 of the last 21 months since May 2020. The results put the level at $80.1 billion (see first chart). However, accelerating price increases have an impact on capital goods. In real terms, after adjusting for inflation, new orders for nondefense capital goods were $50.1 billion in January, measured in 1982 dollars, a high level by historical comparison but well shy of the record high (see first chart).

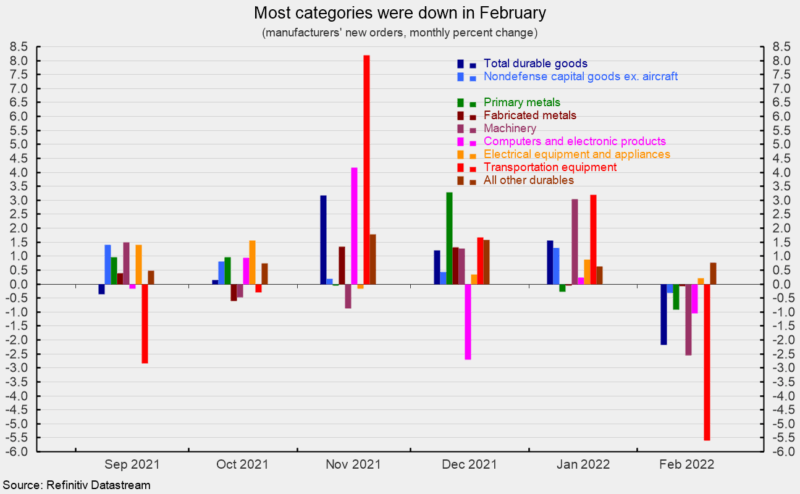

Among the categories in the report, decliners outnumbered gainers five to two. Among the individual categories, the catch-all “other durables” category rose 0.8 percent while electrical equipment and appliances added 0.2 percent. On the downside, transportation equipment sank 5.6 percent. Within the transportation equipment category, motor vehicles and parts decreased 0.5 percent as auto manufacturers continue to struggle with chip shortages and nondefense aircraft lost 30.4 percent, but defense aircraft jumped 60.1 percent. Machinery orders decreased by 2.6 percent, computers and electronic products fell 1.1 percent, primary metals were off 0.9 percent, and fabricated metal products eased back by 0.1 percent (see second chart). From a year ago, every major category shows a gain.

Despite the February setback, durable-goods orders continue to be strong, particularly the core-capital goods components, though some of the gain in nominal-dollar orders is due to price increases. Demand remains robust for the manufacturing sector, and the tight labor market creates incentives to substitute capital for labor. The pandemic may have accelerated structural changes to the economy, affecting labor, housing, manufacturing, and services.

However, the outlook remains uncertain. Sustained upward pressure on prices continues with demand outpacing supply as labor and materials shortages hamper production, the Federal Reserve has begun an interest rate tightening cycle boosting the probability of a policy mistake, and the Russian invasion of Ukraine has unleashed a wave of volatility and disruptions to the global economy. Caution is warranted.

0 Comments