The various segments within housing construction had widely varying results in April. Total housing starts fell to a 1.569 million annual rate in April from a 1.733 million pace in March, a 9.5 percent decrease. From a year ago, total starts are up 67.3 percent. For housing permits, total permits rose 0.3 percent to 1.760 million in April from 1.755 million in March. Total permits are 60.9 percent above the April 2020 level.

The dominant single-family segment saw starts fall 13.4 percent for the month to a rate of 1.087 million but are up 58.7 percent from a year ago. Single-family permits were off 3.8 percent at 1.149 million (see first chart).

Starts of multifamily structures with five or more units rose 4.0 percent to 470,000 and are up 95.7 percent over the past year and starts for the two- to four-family-unit segment plunged 53.8 percent to 12,000. Multifamily permits for the 5-or-more group rose 11.1 percent to 559,000, a rise of 44.4 percent from a year ago, while permits for the two-to-four-unit category dropped 10.3 percent to 52,000. Combined, multifamily permits were 611,000, up 8.9 percent for the month (see first chart), and just the fourth month above 600,000 since the mid-1980s. Single-family home construction had been one of the strongest parts of the economy last year and excluding the plunge in activity during the government-enforced lockdowns in early 2020, single-family housing activity has been on an upswing for most of the last decade, recovering from the housing bubble and collapse of the late 2000s (see first chart). The post-lockdown recovery has been supported by a surge in demand as consumers sought less dense housing. However, since October 2020, multifamily permits have staged a strong recovery, gaining 34.6 percent and since December, single-family activity has been trending slightly lower. It may be that some of the rush to less dense housing that drove single-family activity in 2020 is starting to ease as the economy opens, more people get vaccinated, and workers return to offices.

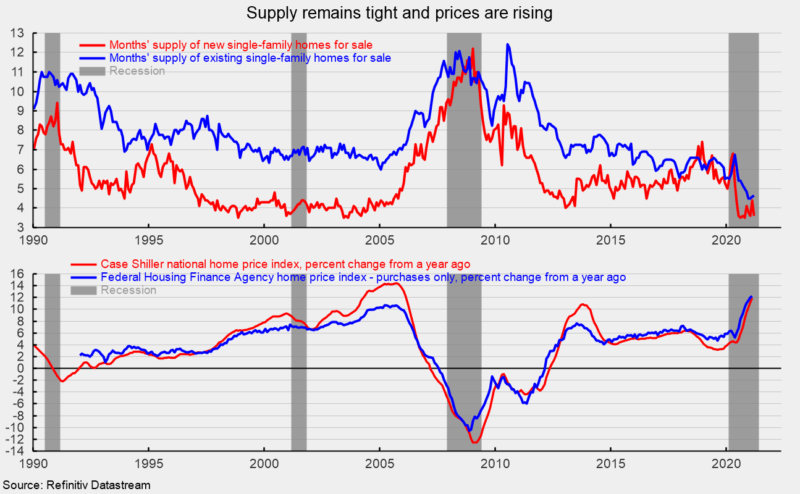

Despite some possible reversing of home ownership preferences, home prices continue to post strong gains amid continuing tight supply (see third chart). If the recent trends continue, price increases are likely to decelerate and supply constraints should begin to ease.

Overall, housing may have enough momentum to grow at a solid pace in 2021 but the combination of reverting home preferences and rising home prices will likely lead to some cooling.

0 Comments