In the past month, we’ve seen some of the largest bank failures since the Great Financial Crisis, with Silicon Valley Bank (SVB) leading the way, followed by Signature Bank and Credit Suisse. While averting financial meltdown should be the top priority, there is no better time to discuss what caused the crisis in the first place, so as to not repeat the same mistakes.

Many posit that the Federal Reserve’s — and other central banks’ — rapid monetary tightening has devalued long-term assets, causing massive unrealized losses on banks’ balance sheets, prompting depositors to pull much of their savings from banks. While such views are reasonable, we ought to look at why banks were not better prepared to deal with rising rates that would inevitably distort their balance sheets. If numerous firms (in any industry) make the same mistake at the same time, it is unlikely that simply “poor management” was the cause. Some underlying signals were causing them to ignore seemingly obvious risks.

Contrary to currently widespread belief, Silicon Valley Bank was once well-hedged against rising rates. In April 2021, SVB’s CFO Daniel Beck publicly reported that the bank had hedges on $10 billion worth of available-for-sale bonds, explicitly stating the reason for doing so was to “mitigate the impact of potential further rate movement” in the upward direction. Only a little over a year later, however, SVB leaders told investors they were “shifting focus to managing downrate sensitivity.” By the end of 2022, only $563 million of its $26 billion securities were hedged against rate hikes, down from $15.3 billion the prior year. Silicon Valley Bank was indeed prepared to deal with rate hikes, but backtracked due to belief in coming rate cuts.

To understand whether such an expectation was misguided, we ought to examine the period following the Great Recession, when monetary policy drastically changed course. This was the beginning of the “ample reserves” floor system, in addition to repeated periods of Quantitative Easing.

From December 2008 through June 2017, the Federal Funds Rate was held below 1 percent. The Yellen-led Fed began to raise rates for a few years, until the start of COVID-19, when Chairman Powell once again brought rates back to near-zero levels without hesitation. Market participants began to understand that near-zero rates were the new norm in the face of any economic adversity.

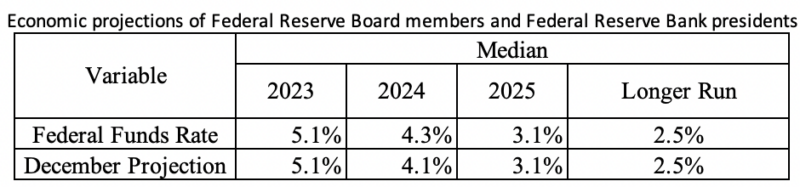

In late 2021 and 2022, the United States experienced its highest observed price inflation since the Great Inflation of the 1970s and 1980s. Since then, the Fed leaders have made it abundantly clear that stomping out inflation is their number one priority, even if rising unemployment is a consequence. Beginning in March 2022, the Fed embarked on its fastest increase of interest rates in the nation’s history. In spite of that, both real and nominal long-run interest rates remain at historically average levels, due to expectations of future rate cuts. And those views are vindicated, given that the Fed’s own forecasts indicate it will be cutting rates soon, as shown below.

Now put yourself in the shoes of a bank executive. You know the Federal Reserve is raising rates to stymie inflation, which will devalue many of your bank’s long-term assets, causing unrealized losses. But how much of an issue are the unrealized losses if the Fed will soon cut rates, allowing you to simply hold your assets until maturity and likely see a realized gain? Not such an issue if that’s the case.

In the counterfactual case, where the Fed had not set such firm expectations of rate cuts following an economic downturn through its current forecasts and existing precedent, most banks would likely have hedged rate-hikes more thoroughly, since future realized gains would not be perceived as such a guarantee.

This is not to say that misaligned signals by the Fed and other institutions were the only cause of the current banking crisis. Poor risk management was also a factor. As chart 7 in the FDIC’s Quarterly Banking Profile (Q4 2022) clearly shows, the banking industry as a whole was experiencing extensive unrealized losses due to rate hikes. But only a few firms are failing.

Silicon Valley Bank did indeed have a 185:1 debt-to-equity ratio, in addition to being technically insolvent, which were the primary drivers of large customers like Peter Thiel pulling deposits. Furthermore, even though SVB believed the Fed would cut rates soon, SVB held on to far fewer interest-rate swaps and options (like caps) than other, larger banks, because it expected inflation to fall faster than it did, and for the Fed to cut rates sooner.

While moral hazard definitely has contributed to the lack of risk aversion on the part of banks, prior trends of monetary conditions have been the primary driver of the banking crisis in the United States, and quickly the rest of the developed world. It’s crucial for policymakers to not revert to zero interest rates and ample liquidity, and go down the same cycle once again.

0 Comments