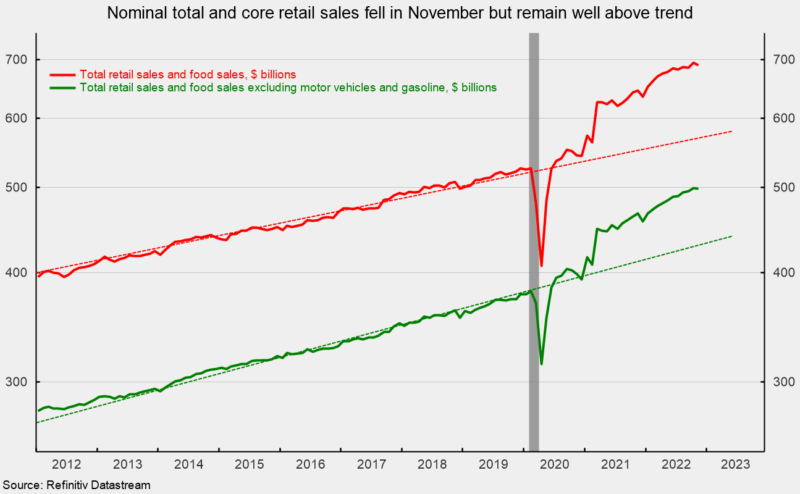

Total nominal retail sales and food-services spending fell 0.6 percent in November after increasing 1.3 percent in October. From a year ago, retail sales are up 6.5 percent and remain well above the pre-pandemic trend (see first chart).

Nominal retail sales excluding motor vehicle and parts dealers and gasoline stations – or core retail sales – fell 0.2 percent in November, following an 0.8 percent gain in October. From November 2021 to November 2022, core retail sales are up 6.7 percent. As with total retail sales, core retail sales remain well above the pre-pandemic trend (see first chart).

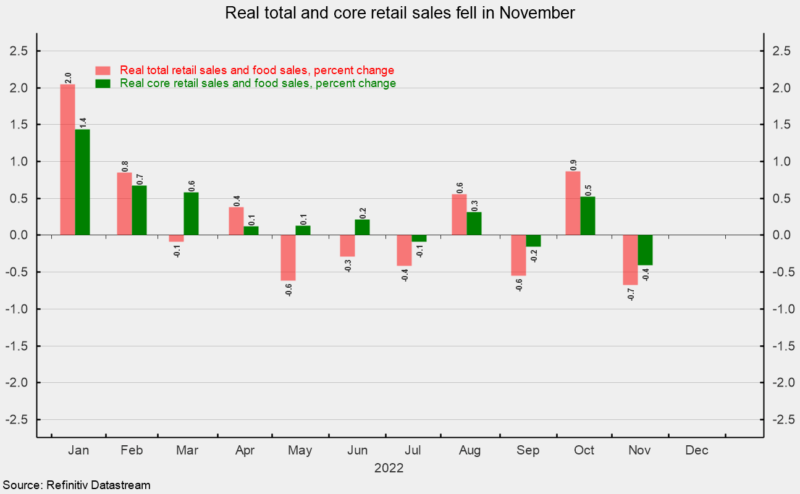

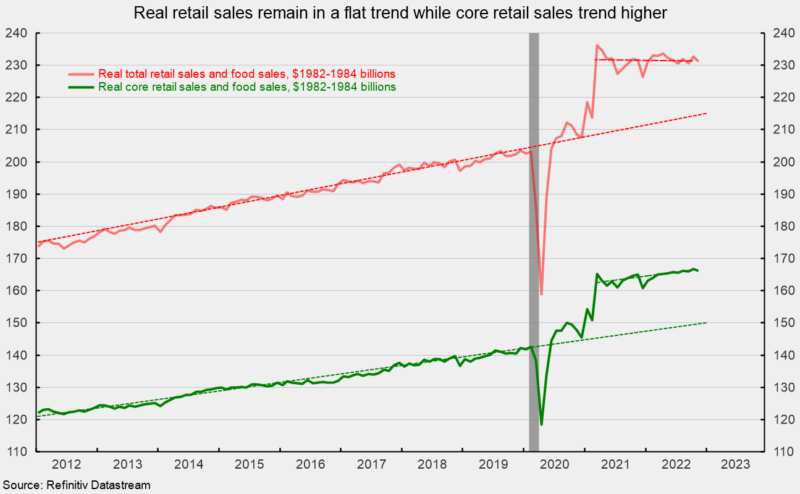

However, these data are not adjusted for price changes. In real terms (adjusted using the CPI), real total retail sales fell 0.7 percent in November following a 0.9 percent increase in October. Real total retail sales have declined in six of the last nine months (see second chart). From a year ago, real total retail sales are down 0.6 percent versus a ten-year annualized growth rate of 2.5 percent from 2010 through 2019. As with nominal retail sales, real retail sales remain well above their pre-pandemic trend, but since March 2021, they have been trending flat (see third chart).

Real core retail sales posted a 0.4 percent drop in November after rising 0.5 percent in October, the third decline in the last five months (see second chart). Over the last twelve months, real core retail sales are up 0.7 percent versus a ten-year annualized growth rate of 2.2 percent from 2010 through 2019. While real total retail sales are trending flat, real core retail sales have been trending higher at a rate of about 1.6 percent per year (see third chart).

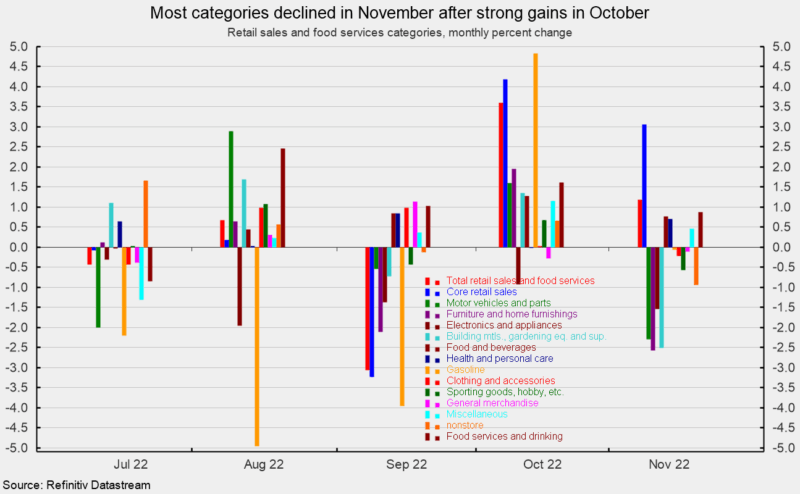

Categories were generally lower in nominal terms for the month, with nine down and four up in November (see fourth chart). The gains were led by food services and drinking places (restaurants), with a 0.9 percent gain, followed by food and beverage store sales (groceries), up 0.8 percent, and health and personal care store sales, up 0.7 percent.

Declines came in furniture and home furnishings (-2.6 percent), building materials, gardening equipment and supplies (-2.5 percent), motor vehicles and parts retailers (-2.3 percent), electronics and appliance stores (-1.5 percent), and nonstore retailers (-0.9 percent). Gasoline spending fell 0.1 following a 4.8 percent surge in October. The average price for a gallon of gasoline was $3.96, off 4.2 percent from $4.13 in October, suggesting price changes more than accounted for most of the drop.

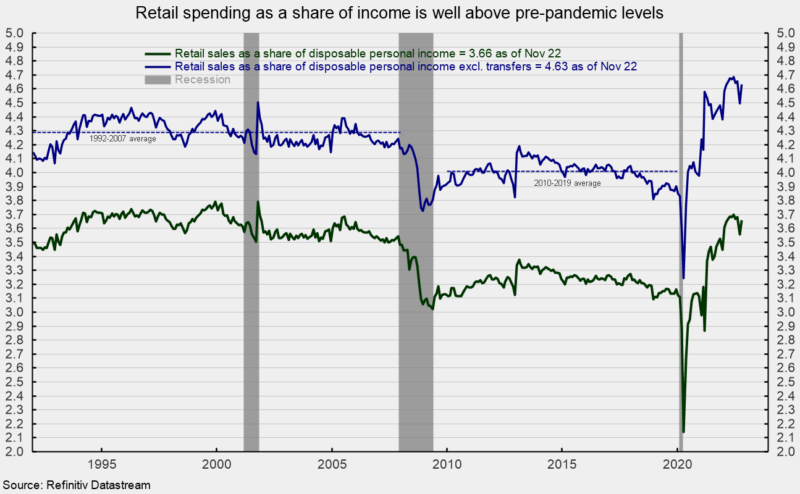

Overall, nominal total and core retail sales remain well above trend. However, rising prices are still providing a significant boost to the numbers. In real terms, total and core retail sales posted declines in November, and the trends are much weaker. Retail spending measured as a share of personal income remains well above the average shares seen in the 2010 through 2019 period and the 1992 through 2007 period (see fifth chart).

Sustained upward pressure on prices is likely affecting consumer attitudes and spending patterns. As more and more consumers feel the impact of inflation, real consumer spending may be under pressure. Furthermore, an aggressive Fed tightening cycle may lead to significant demand destruction. Both phenomena raise risks for the economic outlook. In addition, the fallout from the Russian invasion of Ukraine and outbreaks of COVID in China continue to disrupt global supply chains. The outlook is highly uncertain. Caution is warranted.

0 Comments