Hong Kong’s implementation of draconian COVID policies threatens its status as an international financial hub. This is seen through Hong Kong Chief Executive Carrie Lam’s execution of Chinese President Xi Jinping’s ‘Zero-Covid’ policy amid crippling economic strain and a fifth wave of COVID-19 infections. Lam’s pandemic strategy, compounded with concerns over the National Security Law (NSL), undermines the liberties that Hong Kong is known for.

Hong Kong as an International Financial Hub

Strong legal protections for investors are important for financial growth. Hong Kong maintains significantly more investor protections and freedoms than does mainland China. After the 1997 handover, the Chinese and British allowed the city’s democratic and capitalist system to persist autonomously from mainland China’s socialist system. This institutional framework is known as the ‘One Country, Two Systems’ principle. Hong Kong’s preexisting liberal institutions and business-friendly policies, like judicial integrity, rule of law, and private property continue to bolster its economic appeal.

Hong Kong also possesses unique economic advantages. Unlike other Chinese cities, Hong Kong maintains a low tax regime, diverse financial markets, and free-flowing capital. It is an investor’s gateway into mainland China’s stringently controlled capital markets. The Council on Foreign Relations’ Eleanor Albert notes that its “capitalist features have made Hong Kong one of the world’s most attractive markets and set it apart from mainland financial hubs.”

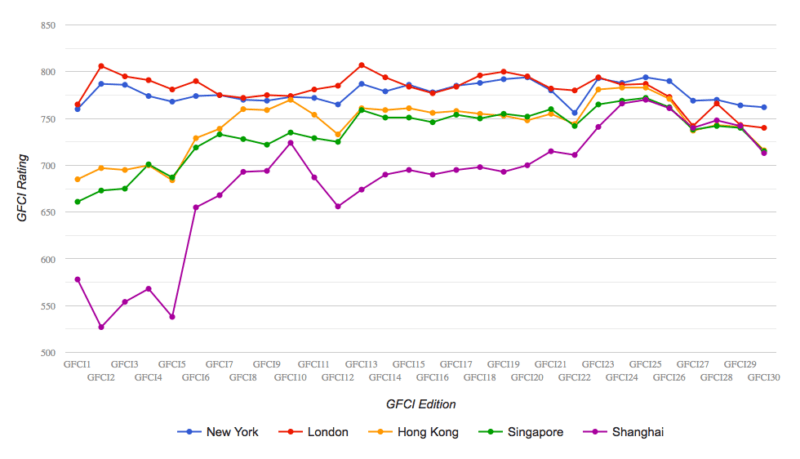

Hong Kong attracts multinational corporations with its pro-business environment. It consistently ranks among the top five international financial centers, according to the Global Financial Centers Index (GFCI) data. The graph below displays the top five financial centers’ GFCI ratings since 2012, in which Hong Kong steadily rivals its peers. Its high GFCI rating indicates its competitive financial infrastructure, legal protections, and open market norms.

Liberty Under Attack

Liberal values and economic policies support Hong Kong’s allure to businesses. The implementation of the National Security Law (NSL) and the enforcement of ‘Zero-Covid’ policies undermine the liberties foreign businesses have enjoyed in Hong Kong. The NSL criminalized vaguely defined acts of “seccession, subversion, terrorism, and collusion.” This crackdown laid the foundation for international businesses’ skepticism and concern over continued operations in Hong Kong. The impact of its COVID-19 strategy has similar outcomes.

The ‘Zero-COVID’ plan attempts to stop the spread of COVID-19 through strict border restrictions, social distancing rules, mandatory testing and vaccination, and lengthy quarantine times. Chief Executive Lam asserted that “existing laws would not stand in the way” of their pandemic strategy, but this relentless pursuit to eliminate COVID hinders basic freedom of movement and disrupts business operations. Meanwhile, corporate leaders and staff question if Hong Kong is still an attractive city in which to do business.

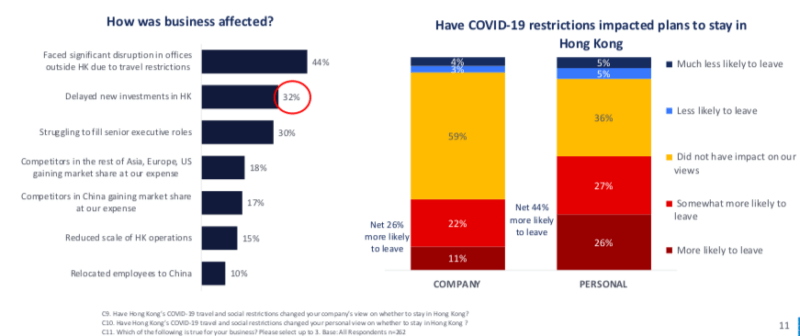

According to the Hong Kong American Chamber of Commerce’s (HK AmCham) 2022 Business Sentiment Survey Report, COVID-related travel restrictions and quarantine rules “weighed heavily on both company and personal sentiment.” Business sentiment soured as restrictions hampered operations, investments, and hiring. Individual pessimism aligned with business attitudes as more than 50 percent of respondents considered leaving Hong Kong.

The pessimism over restrictions underpins the consequent brain drain as top business leaders leave Hong Kong. Former HK AmCham President Tara Joseph resigned in 2021, as tightened travel restrictions and quarantine requirements gained traction. Business executives attributed “travel restrictions and COVID quarantines” to making Hong Kong uncompetitive, while hiring and retention challenges exacerbated their disdain. The consequent exodus of foreign talent was keenly felt in the banking sector. JP Morgan and Citigroup Inc.’s senior departures, V.F. Corporation’s operations relocation, and staff departures from Mandarin Oriental, Bank of America, and Pernod Ricard have each taken a toll.

Hong Kong’s COVID policies threaten a fundamental pillar of the global financial center: liberty. Constraints on the “free movement of people and ideas” intensify business operational difficulties and, more broadly, isolate Hong Kong from the world. If financial hubs prevent individuals from traveling freely, then companies and individuals will not return, or they will simply relocate to Hong Kong’s more free Asian rival, Singapore.

Singapore is a popular alternative financial center to Hong Kong. In contrast to Hong Kong’s anti-business COVID strategy, Singapore allows quarantine-free entries from designated countries and is “transitioning to living with the virus.” Bloomberg economists Tamara Mast Henderson and Eric Zhu compiled data showing that businesses “weary of stringent quarantine rules and the inability to travel freely,” are relocating from Hong Kong to Singapore.

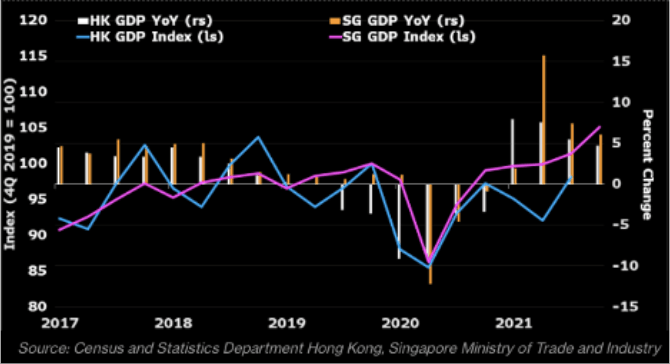

According to the data below, Singapore’s GDP growth from 2020 into 2021 outpaced that of Hong Kong’s. While both finance hubs implemented harsh COVID restrictions strategies, Singapore was the first to relax travel restrictions and social distancing rules.

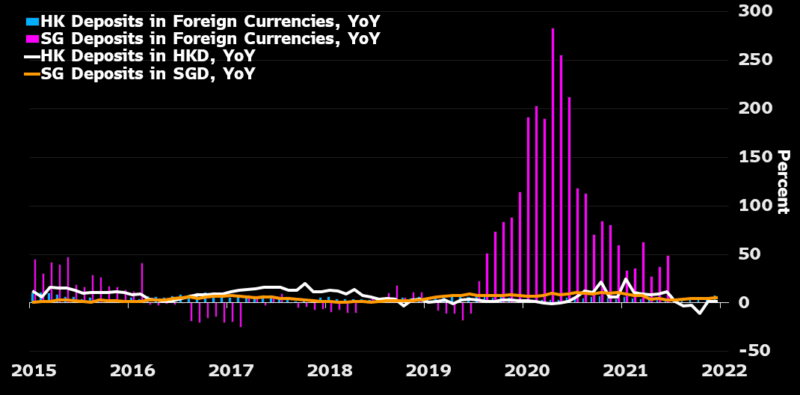

The most tell-tale sign of business preference for Singapore is bank deposits. Henderson and Zhu’s analysis show Hong Kong’s deposit growth “roughly halved in the last three years,” and Singapore’s deposits grew “about double the pace” in the same amount of time.

What this means for Hong Kong

Although its ‘Zero-COVID’ strategy drove foreign talent and companies to Singapore and locals to emigrate, Hong Kong still possesses three unique advantages that solidify its place as a finance powerhouse.

First, there is a deep, indigenous talent pool that can replace expats who left. Hong Kong and mainland Chinese talent can fill vacated expats’ roles in the finance sector.

Second, Hong Kong’s geographic proximity and financial interconnectedness with mainland China is unmatched. Although Singapore is a close competitor, it enjoys neither Hong Kong’s level of economic integration with the mainland, nor Chinese clientele trust.

Third, Hong Kong’s success is backed by mainland China. Despite crackdowns on civil liberties, its economic policies were untouched, and Chinese investors strongly supported its stock markets during downturns. However, a caveat, as Asia Business Council executive director Mark Clifford assesses, is that “Hong Kong must succeed on Beijing’s terms.” Thus far, Beijing believes that it can thrive in the absence of liberty.

A former bank chief executive at one of Hong Kong’s largest banks observed, “Hong Kong’s value will not be zero, but it will be different.” It is still the main gateway into China. However, its liberty purge spoiled business confidence, and the long-term effects of ongoing geopolitical tensions are yet to be seen.

0 Comments