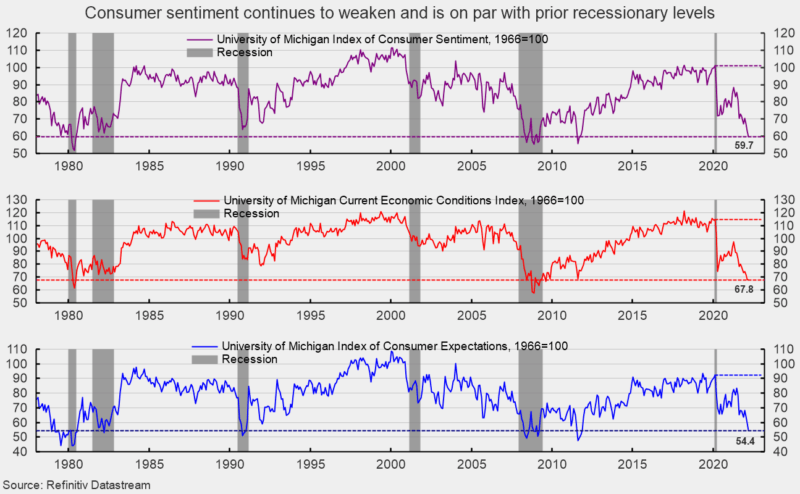

The preliminary March results from the University of Michigan Surveys of Consumers show overall consumer sentiment fell again in early March, hitting the lowest level since September 2011 (see top of first chart). The composite consumer sentiment decreased to 59.7 in early March, down from 62.8 in February, a drop of 4.9 percent. The index is now down 41.3 points from the February 2020 peak.

The current-economic-conditions index fell to 67.8 from 68.2 in February (see the middle of the first chart). That is a 0.4-point decrease for the month and leaves the index with a 47-point drop since February 2020.

The second sub-index — that of consumer expectations, one of the AIER leading indicators — sank 5 points for the month, dropping to 54.4 (see bottom of first chart). The index is off 37.7 points since February 2020.

All three indexes remain below the lows seen in four of the last six recessions (see first chart). According to the report, “Consumer Sentiment continued to decline due to falling inflation-adjusted incomes, recently accelerated by rising fuel prices as a result of the Russian invasion of Ukraine.” The report goes on to add, “Consumers held very negative prospects for the economy, with the sole exception of the job market. Consumers were slightly more likely to anticipate declines rather than increases in the national unemployment rate.”

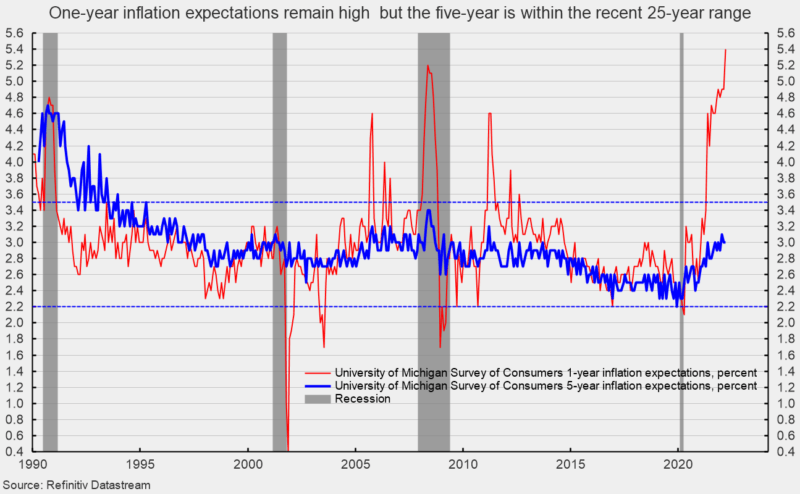

The one-year inflation expectations jumped to 5.4 percent in early March, the highest level since November 1981. The one-year expectations has spiked above 3.5 percent several times since 2005 only to fall back (see second chart). The five-year inflation expectations remained unchanged at 3.0 percent in early March. That result remains well within the 25-year range of 2.2 percent to 3.5 percent (see second chart).

According to the report, “The year-ahead expected inflation rate rose to its highest level since 1981, and expected gas prices posted their largest monthly upward surge in decades. Personal finances were expected to worsen in the year ahead by the largest proportion since the surveys started in the mid-1940s.”

The report adds, “The greatest source of uncertainty is undoubtedly inflation and the potential impact of the Russian invasion of Ukraine. In the March survey, 24% of all respondents spontaneously mentioned the Ukraine invasion in response to questions about the economic outlook. The impact of this recognition was associated with a drop of 13.2 Index points in the Index of Consumer Expectations across all households. The difference was much larger for those who held higher inflation expectations: the difference was 33.5 Index-points on the Expectations Index for those who expected under 5% compared with over 5%.” The substantial declines in consumer sentiment reflect the impact of higher consumer prices. The surge in prices for many consumer goods and services is largely a function of shortages of materials, a tight labor market, and logistical issues that prevent supply from meeting demand, and has been compounded by surging energy prices as a result of the Russian invasion of Ukraine. Furthermore, a soon-to-be-initiated Fed tightening cycle raises the risk of a policy mistake and adds to the extreme level of risk and uncertainty to the overall economic outlook.

0 Comments