As government-imposed lockdown measures confined hundreds of millions of Americans to their homes, many began to entertain DIY projects they previously hadn’t the time or resources to complete. Over 75 percent of homeowners surveyed by Porch.com in July 2020 had completed a home improvement project since the beginning of the pandemic. Would-be craftsmen who have waited until now to begin renovations may be out of luck, however––over the past year, the price of lumber has skyrocketed, and home project expenses have risen with them.

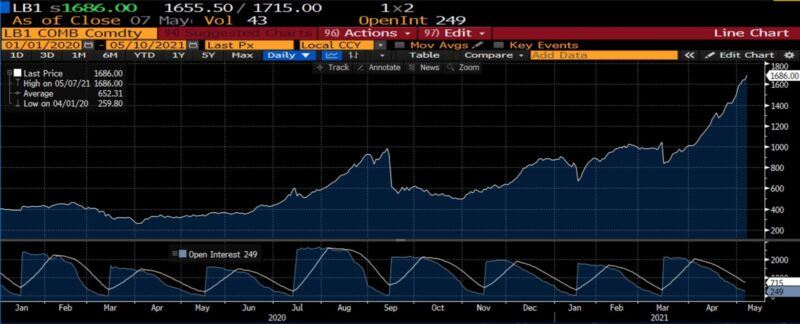

From a price of $259.80 per thousand board-feet (the standard unit of lumber trading) on 1 April 2020, on Friday 7 May 2021, the price of lumber had risen to $1,686 per thousand board-feet as the DIY boom coincided with dire challenges to the lumber industry, including increased home building, mill closures, and staffing shortages.

Lumber prices per thousand board-feet (2020–Present)

Construction crews began to build homes with scarce materials, exacerbating shortages. Even a year on, mill capacity is limited, and production simply cannot meet the booming demand.

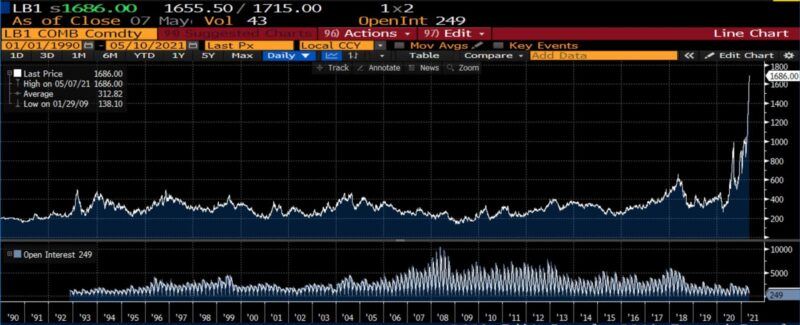

Lumber’s meteoric price rise has been unprecedented. In the futures markets, where producers and users of commodities trade to hedge against unanticipated changes of price over longer periods of time, lumber markets have typically been among the most quiescent, especially compared to crude oil, gold, natural gas, and soybeans. In fact, lumber contracts have typically been neck-and-neck with frozen concentrated orange juice (FCOJ) contracts at the bottom of daily trading volumes ranked among all such derivatives. Indeed, with only a handful of exceptions between the mid-1980s and late 2019, the price of lumber per thousand-board feet has traded somewhat listlessly between $200 and $500. Yet front-month lumber has risen 450 percent between the end of 2019 and the end of April 2021, with the period between March 26 and April 19, 2021 showing an unbroken run of 16 daily price increases and a number of limit-up triggers along the way.

Without suggesting that the rise in prices has been purely speculative, perhaps the modern embodiment of Joseph P. Kennedy Sr.’s barometer of frenzy––stock tips from shoeshine boys––is found in the burst of TikTok videos taking notice of prevailing market conditions. (Many employ the hashtags #lumberprices and #woodprices.)

Great Recession Origins

The circumstances explaining skyrocketing prices, at least in part, trace back to policies implemented by President Barack Obama in the wake of the Great Recession. Until that point, as a 2011 paper summarizes,

The first decade of the twenty-first century proved tumultuous for the West[ern US] forest products industry. A strong economy, low interest rates, easy access to credit, and real estate speculation fostered more than two million US housing starts in 2005 and record lumber consumption from 2003 to 2005. With the decline in US housing beginning in 2006, the 2008 financial crisis, an over 50-year record low 554,000 housing starts in 2009, wood product prices and production fell dramatically. In 2009 and 2010, virtually every major western mill suffered curtailments and 30 large mills closed permanently. Sales value of wood and paper products in the West dropped from $49 billion in 2005 to $34 billion in 2009. Employment declined by 71,000 workers and lumber production fell by almost 50 percent from 2005 to 2009. Capacity utilization at sawmills and other timber-using facilities fell by from over 80% in 2005 to just over 50% in 2009 and 2010.

For obvious reasons, the lumber industry was one of the worst-hit sectors; the housing market at the center of the financial crisis put a halt to new construction. The economy was weak and unemployment remained high, despite Obama’s American Recovery and Reinvestment Act of 2009 and tax cuts implemented by President Donald Trump. As Ryan Cooper explains in The Week,

After 2008, residential investment as a share of the economy plunged to the lowest level recorded since 1947, and recovered with grinding slowness –– only returning to the level of the previous record low in mid-2014. So not only did the lumber industry take a massive hit, it did not experience any kind of rebound in demand for over a decade.

In the ensuing years, firms resorted to operating on thin margins due to now-conservative expectations. (More about this, below.) When the pandemic struck, nonpharmaceutical interventions such as lockdowns, business closures, and social distancing hit individuals and firms, and lumber production capacities were further reduced: In Canada and the United States, many mills had to close temporarily or permanently, and only a year into the pandemic have some begun to spring back.

In isolation, this decline may not have caused such an atypical rise in lumber prices. And ironically, as lockdowns and shutdowns were initially imposed, lumber producers and wholesalers canceled outstanding orders. As further reduced production capacities intersected with the precipitous rise of the pandemic DIY movement and the downward spike in mortgage rates, it’s little wonder that lumber became a precious commodity.

At a broader level, in the last quarter of 2020, residential investment reached 4.6 percent of GDP––a recent peak. This momentum was underscored by further exacerbations of existing lumber supplies, and now that construction season is upon much of the U.S., the situation is likely to worsen before it improves.

U.S. Producer Price Index for logs, bolts, timber pulpwood, and wood chips (1980–Present)

Just a few weeks ago, on April 16, Chicago Mercantile Exchange Random Length Futures contracts for every 2021 delivery month tallied above $1,000 per board foot. (For comparison, as of April 16, 2020, a May 2021 futures contract traded at around $345.) Lumber production, for its part, has begun to rebound; this past February, it hit a 13-year high. But so long as demand remains hot––both for materials for small-scale projects and grand residential investment––lumber prices will almost certainly stay high.

Of course, supply and demand will converge before long, as they are wont to do; encouraged by high prices, producers will send lumber to market and alleviate supply shortages, while would-be buyers will be priced out of the lumber market until prices drop sufficiently.

The Reliability of Bad Ideas

The meteoric rise of prices has led to the addition of price escalation clauses to sales and construction contracts. According to a Woodworking Industry News poll, some 47 percent of responding builders report shifting from a shared cost default (where builders and homeowners share the expense of rising input prices) to contractual stipulations that adjust the final cost of the home to the change in the cost of lumber.

The fortunes of well-positioned companies are readily apparent. The stock price (white) and per-share earnings estimates (red) of Canadian lumber, strand board, plywood, pulp, and paper producer Canfor Corporation from just before the pandemic began until now is shown below.

Canfor Corp (2019–Present)

Yet despite contract changes, hedgings, and a handful of other market-oriented solutions (including employing substitutes where possible), misguided policy recommendations soon materialize where financial or economic extremes exist.

Predictably, no fewer than 37 groups with varying proximities to the timber industry have called upon the Biden administration for aid. It’s difficult to imagine what form of government aid those lumber firms and groups may have in mind other than direct subsidies, since trees take time to grow and certain protectionist measures (tariffs, for instance) are already in place. Some will no doubt take note of the advantages of “proximity to the trough,” as demonstrated by another, highly specialized arboreal subsector:

A few months ago, those who supply America’s homes with fresh Christmas trees were approved for special aid by the US Department of Agriculture to help against the economic ravages of the coronavirus pandemic. Frozen out were the people harvesting their less glamorous industrial cousins: loggers and truckers behind the nation’s construction, paper, and furniture-making industries. Only farmers who provided species like firs and spruces to Christmas tree lots were greenlighted for relief…The reason: an only-in-Washington tale of the importance of lobbying and political connections. The National Christmas Tree Association, along with the larger nursery trade group, American Hort, has worked the corridors of power for decades [with] a full-time team of lobbyists in Washington at a cost of $1 million cumulatively over the past decade…By comparison, the American Loggers Council, which represents the logging industry and log truckers, has spent $85,000 on lobbyists over the same period and has no PAC. “We have been in DC since at least the 1940s or 1950s,” said Craig Regelbrugge, the chief lobbyist for American Hort. “It’s fair to say that having a consistent presence and relationships is a huge strategic advantage for the industry.

That is an advantage, one predicts, that will soon be sought by the less foresightful lumber subsectors. Identifying the inability of timber mills to meet current demand as rooted in excessive caution following the Great Recession housing collapse, the aforementioned Cooper comments that,

The result of th[ose] choices was a prolonged depression in housing construction….A whole decade passed where wood sales were chronically weak, and anyone who tried to boost production risked bankrupting themselves (particularly because it is very expensive to grow, harvest, transport, and store wood)…The problem is not excessive demand, the problem is lack of supply consistent with what is needed to provide housing for the American people. [Emphasis in the original.]

The previous residential building boom and its effects on timber production were products of the expansionary monetary policy stance the Federal Reserve assumed in the wake of the bursting of the dot-com bubble and the 9/11 attacks. What Cooper assumes to be the normal or ordinary state of affairs distorted in 2008 was a previous boom-bust cycle: the creation, exposure, and liquidation of malinvestment in housing and related industries, including lumber. Instead, what he and others are assuming was the routine course of housing market growth was mostly a product of credit expansion: the artificial lengthening of the term structures of production accompanied by an artificial lowering of interest rates, which drove down mortgage rates.

Cooper continues:

Following the advice of conservative economists like Mickey D. Levy and Michael D. Bordo, who argue that the Federal Reserve should be ready to hike interest rates to forestall any inflation, would only strangle the economy so that people once again are unable to afford housing. To adopt John Maynard Keynes, this idea “belongs to the species of remedy which cures the disease by killing the patient.”

Consider the following gedanken experiment: If lumber-employing firms characterized as overly cautious after the 2007–2009 correction had remained the same or continued growing in the post-crisis period, would this point not have been reached much sooner, with timber products exhausted long ago and quite possibly at much higher prices? Would lumber shortages as early as May or June 2020, with prices at $2,000 or $3,000 per thousand board-feet and the concomitant effects seen on housing and in other areas, be superior to what we see today?

Average weekly hours, US sawmill employees (Jan 2020–Present)

One wonders where pundits think that the impact of interventionist campaigns begin or end, and/or whether they believe that such programs are so neat and tailorable that unintended outcomes can be disregarded. At any rate, advocating for new government measures to address the unanticipated, pernicious effects of previous government measures is in keeping with the noblest traditions of punditry.

On It Goes

One of the extraordinary moments following the unprecedented government response to the Covid-19 pandemic, where the May 2020 West Texas Intermediate oil futures contract settled at a negative price (-$37.63/barrel), represents the opposite of the current lumber situation.

In that case, a dispute between “OPEC+” (Saudi Arabia and Russia) led to a price war, with a superabundance of oil being released on world markets at nearly the same time that lockdowns reduced travel to a standstill. A massive, sudden boost to supply met plummeting demand, with oil and gasoline prices utterly collapsing. With lumber, we see the effects of a nearly-overnight explosion of demand with low and decreasing supply to meet it. And in both cases, the price system functioned as it should: signaling, economy-wide, as to conditions of scarcity or abundance.

Lumber prices per thousand board-feet (1990–Present)

However academically fascinating it may be to examine the recent oddities of the lumber industry, it bears mentioning that consumers and would-be homeowners are feeling the heat. According to Will Ruder of the Home Builders Association of Greater Kansas City, who was interviewed by NPR on All Things Considered, “Shortages are tacking months onto the time it takes to build a house and driving up costs. And he says that for every $1,000 price increase nationwide, more than 150,000 potential buyers are being priced out of the market.” Sales of new single-family homes and new housing starts fell by 18 and 10 percent, respectively.

It’s a classic story of supply and demand, albeit muddied by pandemic complexities. This constellation of considerations has transformed lumber into one of the hottest assets on the market. In time, much of the fervor and many of the complicating factors surrounding lumber will fall to the wayside––but until demand wanes, mill capacity returns to normal, and production can grow accordingly, the exorbitant price of lumber seems to be here to stay. If the promoters of economic interventionism have their way, though, timber markets will become yet another milestone in a long, meandering, and dependable timeline of unforeseen and unintended consequences.

0 Comments