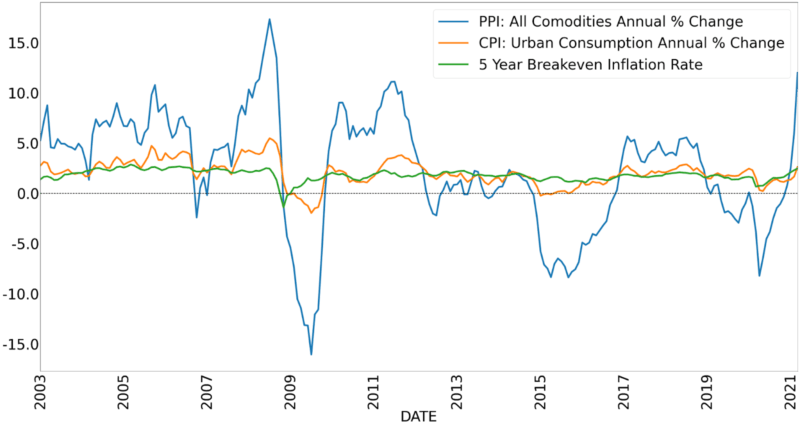

While I strongly expect that we will see higher than expected inflation during the approaching cycle, we are still in the early stage of recovery. Inflation expectations have, so far, not lifted to a level that we would deem above a short-run target of around 2.5%-3%. Today, I will present signs to watch for that may indicate if a significantly higher level of inflation is, in fact, approaching.

Although the 2020 recession was severe, the economy quickly rebounded. Much of the fall in real income was caused by a precautionary shutdown of productive factors. As Covid-19 is receding, so too is the shutdown of these factors.

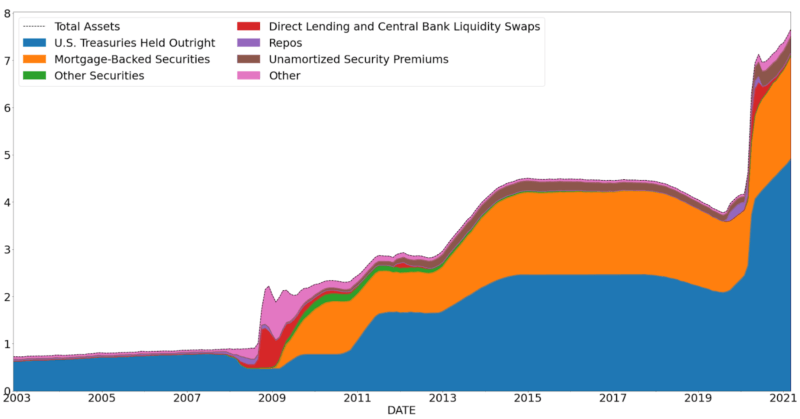

At the beginning of the Covid-19 lockdowns, Jerome Powell was concerned about the possibility of deflation and subsequent destabilization of financial markets. He responded by expanding the Federal Reserve’s balance sheet from a value of approximately $4.2 trillion to greater than $7 trillion. At its current pace of growth, the balance sheet will pass $8 trillion in the next 1 to 2 months. Most of this expansion has been supported by purchases of U.S. debt and mortgage-backed securities.

There are good reasons to be concerned about the prospect of inflation. So far, inflation and inflation expectations have only increased modestly. Some prices, though, have been very responsive to support provided by the Federal Reserve.

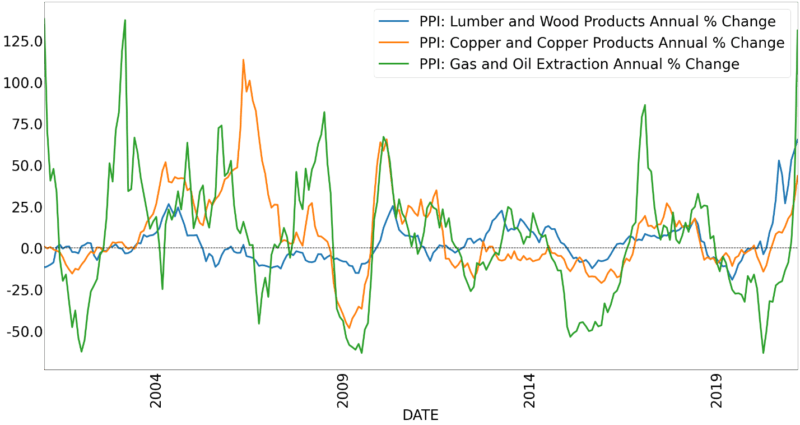

Over the last year, the Federal Reserve has continued to accumulate mortgage-backed securities. It now holds $2.25 trillion worth of mortgage debt. In the 4th quarter of 2020, there existed $16.78 million of mortgages in the United States. We should not be surprised that the price of many commodities have been rising over the last year, especially the price of inputs for construction of new homes. The price of lumber and wood products have more than doubled since April 2020. Many other commodities are following this upward trend. Reflecting this, the producer price index for all commodities has increased by more than 10% over the last year. As we should expect, rising prices of goods used in the early stages of production processes are picking up the inflationary effects of expansion first.

Two questions concerning inflation are yet to be resolved: 1) will the price of these primary inputs continue to rise and 2) will rises in these input prices translate to a rise in the general level of prices? So far, input prices have not pushed to a level that, on their own, justify expectation of rates of inflation, say, in the double digits. Rising prices seem to be drawing resources into production, precisely the goal of the Powell-led Federal Reserve. If prices continue to rise at similar rates over the summer, greater concern will be merited.

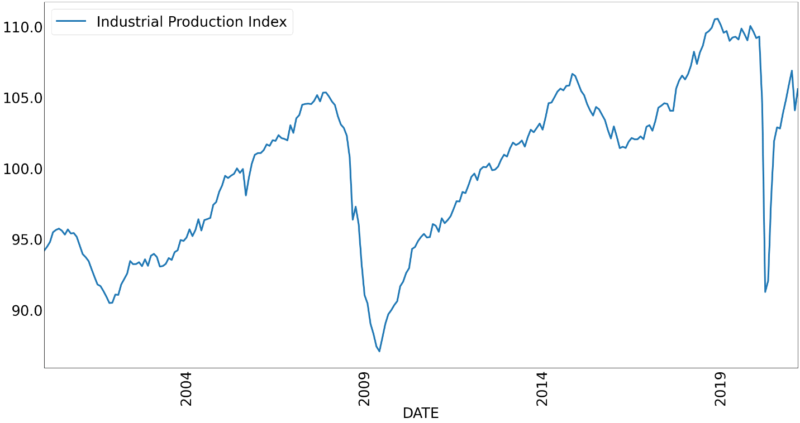

Industrial production is not far from its pre-recessionary highs. As the Industrial Production Index returns to its old highs, increases in total expenditures are more likely to translate into increases in prices rather than increases in the real level of production. If this turns out to be the case, the rise in commodity prices will not be a blip, as they were leading into the 2008 crisis, and the prices of final goods and services will rise in response to the rise in the cost of inputs driven by an increase in total expenditures.

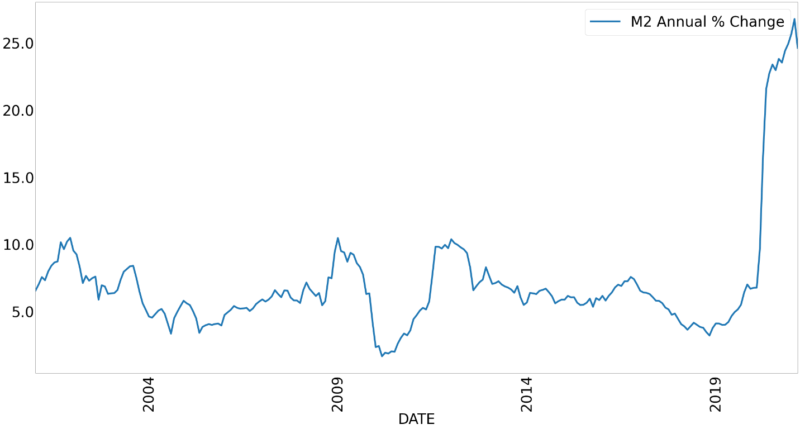

So far, price increases of inputs are not outside the bounds of recent precedent. Even the price of lumber experienced similar increases during the early 2000s. A jump in the producer price index in 2008 was followed by a collapse as the nature of the recession became clear in October of that year. One factor is concerning as the current recovery gains steam: the quantity of money in circulation as measured by M2 has been surging for the last year, a factor not present in past crises in the last several decades. Since expectations were depressed, the increase in M2 was an indication of higher savings rates, owing largely to expansionary fiscal policy in the form of stimulus payments and expanded unemployment benefits. We should expect that as expectations improve, at least a portion of these saved funds will be dedicated to consumption or to investment as returns to investment rise, thus increasing velocity of M2.

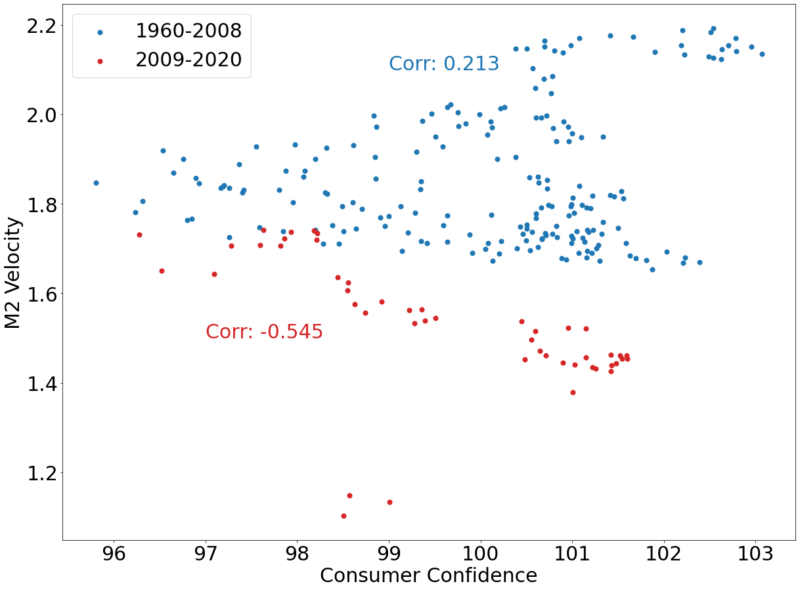

This might not seem to be an obvious problem since, over the last decade, the velocity of M2 has been collapsing. The main reason for this has been stricter lending regulations imposed by Basel III. Specifically, the liquidity coverage ratio acts as a quasi-reserve requirement that limits the level of riskier investments that banks may take in proportion to less risky, more liquid assets. These regulations were mostly implemented across the last decade and are likely responsible for confounding the relationship between consumer confidence and M2 velocity. As consumer confidence returns to pre-Covid-19 levels, however, it is not unreasonable to suggest that velocity of M2 will also move closer to its previous levels. Even a recovery of velocity by 10% – less than half of the fall since the start of the crisis – would significantly lift inflation and, consequently, nominal interest rates. Higher rates may create feedback driving further inflation.

Many investors have let their guard down with regard to inflation. Popular belief is that the Fed has inflation under control. The Bernanke framework that persists to this day has succeeded in preventing expansion of the Federal Reserve’s balance sheet from generating inflation. For the first time since the framework’s implementation, however, Federal Reserve policy is not erring on the side of caution. Monetary policy is intentionally supporting fiscal policy and supporting levels of indebtedness from the Federal government that are unprecedented. The result has been an explosion of M2 that increases the risk of inflation. This fiscal expansion may also aggravate confidence in the soundness of U.S. fiscal policy and, consequently, in the U.S. dollar. It is testing investor willingness to shrug off persistently elevated levels of indebtedness. There is a fair chance that policymakers will succeed. But, for the possibility of success, they risk a monetary-fiscal crisis.

0 Comments