Recently Tesla CEO Elon Musk asked Ark Investment CEO Cathy Wood about her view concerning the Buffett Indicator, which is pointing to a historic overvaluation in stocks and hence suggests a coming crash. She first insinuated that it was outdated. Then she said her team would have a closer look.

As tempting as it is to believe that there is a simple formula out there to reveal the future of financial markets, there are good reasons for doubt. While no measure or method can be expected to be an unfailing determinant of market valuation, the reputation of the Buffett Indicator itself is likely overvalued.

In an article in January I concluded that the S&P 500 was fairly valued. That study was based on a detailed analysis of price-earnings ratios. The conclusions rested on a proper understanding of the importance of expected earnings and dividends rather than the backward-looking Shiller CAPE ratio. I did not believe the Buffett Indicator was relevant to the analysis then because it did not focus on what matters most – earnings.

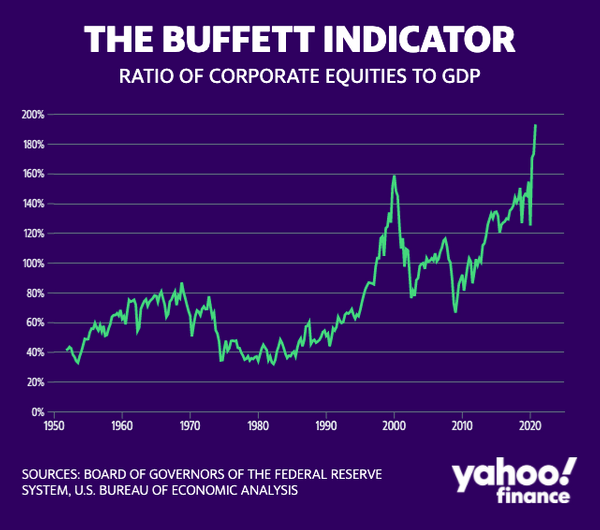

Nonetheless, there is an infatuation with this indicator, which Buffett made popular – so much so that it has reached a fever pitch. The indicator measures the ratio of the market value of publicly traded stocks to the nominal value of GDP. That is, a ratio of asset values to the value of production of all goods and services produced in a given year in the US.

The ratio has increased dramatically to about 200% from the 40-80% range in the period leading up to late 1999.

The Indicator implies a relationship between the value of stocks that do business all over the world with what is produced in the US. There is no explicit link to earnings, dividends, interest rates or risk.

Corporations that trade on the US stock exchanges are global in nature. They do business all over the world. In fact, some of those corporations have major subsidiary operations overseas.

Approximately 40-50% of the revenues and profits of US companies are derived from sales overseas. That percent has grown over the decades. The importance of foreign earnings varies across companies from very high for Apple to nil for local utility companies.

Publicly traded companies have increased in importance in the US economy, more than doubling by value over the last 30 years. What that means is that less and less of the income produced from business activity in the US is from privately held business entities. More and more entrepreneurs have sought to monetize the value of their enterprises by taking them public or selling them to public companies. That trend is accelerating with the advent of SPACs.

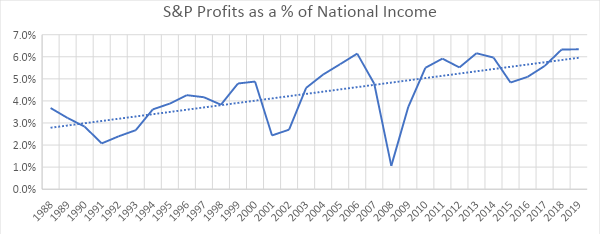

This means more and more of the profits earned by US business are emanating from publicly traded companies. The best proxy for this comes from data from Standard and Poor’s, which calculates the total dollar value of reported profits by companies in the S&P 500 index. The S&P 500 index, though it includes only about an eighth of all US companies traded on US exchanges, and 80% of the capitalization value of all traded companies, does capture over 90% of all the profits captured by publicly traded companies. That is because so many small traded companies have little or no earnings.

Below is a chart of the trend of the importance of publicly traded profits to all income generated in the US economy. The denominator is National Income (NI) rather than GDP, but they are roughly equivalent. The sum of all sources of income in the US (NI), such as wages, salaries and earnings, are roughly equal to the value of all goods and services produced in the final market (GDP).

If we roughly estimate that half the growth in the Buffett Indicator comes from the increased importance of foreign earnings to US corporations, and another half of the growth comes from the increased amount of profits emanating from publicly traded companies, you will nearly eliminate all the upward trend in the Buffett Index.

There are other reasons for the Buffett Indicator ratio to be trending higher. Corporate earnings are growing nearly twice as rapidly as the growth in nominal GDP.

In conclusion, the Buffett indicator, though at high historical levels, is not per se signaling that the market is overvalued.

0 Comments