Earlier this year, China began to roll out a project that had long been in the works––a digital version of its currency, the yuan, is now being used in four Chinese cities. The Chinese government sees two major potential benefits to the experiment: a tangible challenge to the U.S. dollar’s global ubiquity, and a way to control how Chinese citizens spend their money.

As a government-issued currency, the digital yuan can be manipulated and monitored in a number of ways. Importantly, it is programmable. Writes The Wall Street Journal, “Beijing has tested expiration dates to encourage users to spend it quickly, for times when the economy needs a jump start.”

Although the concept of a currency which is artificially inflatable/deflatable on demand seems novel, it has its roots (as do so many concepts) in the theorizing of a long-dead economist. A German entrepreneur by the name of Silvio Gesell witnessed Argentina’s 1890 financial crash firsthand. The ensuing unemployment, poverty, and economic stagnation convinced him that something needed to change. Such crises occurred, he theorized, because people hoarded money out of fear and brought business to a halt, argued Gesell––this he dubbed “poverty amid plenty.”

To encourage quicker spending, disincentivize saving, and therefore avoid more catastrophic financial crashes, Gesell proposed money with an expiration date. “Currency Reform as a Bridge to the Social State,” his first published work, detailed a system in which paper bills would expire unless they were stamped––renewed––for a fee. This ultimately meant that holders of money incurred a demurrage cost, which is the cost of holding a given currency. Because of Gesell’s proposed renewal fee, savings had a negative interest rate.

He called this Freigold, or “free money.” Speaking of his system’s perceived benefits in The Natural Economic Order, Gesell wrote,

Only money that goes out of date like a newspaper, rots like potatoes, rusts like iron, evaporates like ether, is capable of standing the test as an instrument for the exchange of potatoes, newspapers, iron and ether. For such money is not preferred to goods either by the purchaser or the seller. We then part with our goods for money only because we need the money as a means of exchange, not because we expect an advantage from possession of the money. So we must make money worse as a commodity if we wish to make it better as a medium of exchange.

At a time when nations were largely on the gold standard, Gesell’s idea was unorthodox (and unpopular).

Gesell died in 1930, having never seen his monetary system realized. But just two years later, in the deepest depths of the Great Depression, a handful of small and medium towns in the United States and Europe looked to his proposal to soothe their economic distress. The best-known of these cases was the small town of Wörgl, Austria, in which town official Michael Unterguggenberger convinced Wörgl to issue stamped money known as “Certified Compensation Bills.” The experiment came to be known as the “Miracle of Wörgl,” reflecting the town’s success in reducing unemployment and the relative ease with which Wörgl weathered the Depression compared to the rest of Austria. Hawarden, Iowa, and Anaheim, California, inspired by Wörgl’s experience, soon enacted similar policies.

But it must be said that Wörgl’s experiment was likely successful because it, similar to the currency itself, had an expiration date. After just one year, the town put the project to rest. As Jonathan Goodwin wrote, “Once the taxes in arrears were completely paid and when people had paid enough taxes in advance to feel safe and comfortable (at some point they would stop paying forward), the scrip would lose a key part of its attractiveness.”

Of course, even if consumption drove economic growth (and there are a number of both economic and reductio ad absurdum arguments that point out the flaw in that concept), the idea of money that can be coded to decay at tailorable rates is disconcerting.

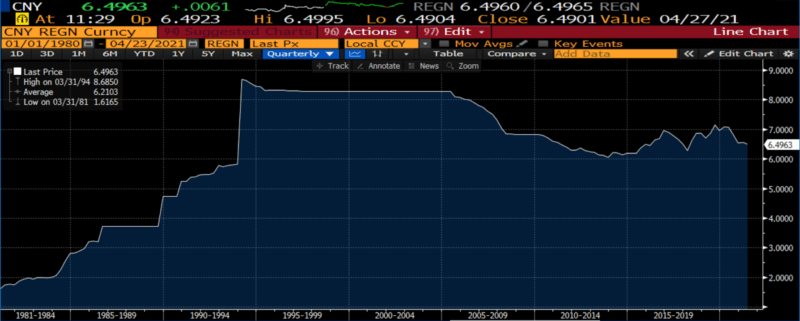

Chinese Yuan spot (40 years)

Central banks are monetary central planners, and the many criticisms that apply to central planning in every other field apply here as well. Their insularity, the blizzard of information they face, and political manipulation result in a preponderance of erroneous, ineffective, or late policy choices, all of which bring about unintended consequences. At times, those unintended consequences become new crises, which demand further policy intervention. Given this inevitability, any expansion of policy armamentaria should be viewed with deep concern. This is true of China’s digital yuan, the Wörgl experiment, and any number of other unconventional monetary policy tools in use now or in the future.

In the specific case of a currency engineered for customizable demurrage, pernicious applications come to mind immediately. The extent to which those are realizable, however, pivots upon a degree of theorizing as to how “targetable” the programmed change of purchasing power will be. (Because such a system will ultimately require the elimination of cash to be fully effective, the warnings associated with a closely-related unconventional monetary policy, negative interest rates, apply here as well.)

A preliminary question is to what extent, or even whether, the induced loss of purchasing power will be communicated by the implementers of monetary policy. It is conceivable that in some nations the disclosure of an impending demurrage operation will be disseminated well in advance and will include specifics regarding the anticipated amount of change; other governments may be less forthcoming. This will likely derive as much from the authoritarian character of the state as from specific policy aims. Further, while in the 1890s the average farmer understood the basics of inflation and deflation (owing to their dealings in grains and other commodities), it may be difficult to expect the same of citizens in the modern age.

By announcing that money will be debased by a discrete amount at a certain point in time, individuals, firms, and other institutions holding money––again, assuming these policies are applied on something akin to an M3 basis––will make decisions based not upon their tastes and needs, but rather upon the desire to convert money to another form in anticipation of the loss of purchasing power. The effect of individuals and large financial institutions singling out certain goods as stores of value under the artificial upward ratcheting of time preference would, as do most other forms of monetary tinkering, inevitably create price distortions and possibly shortages, depending on the availability of local goods and services.

Should the ability to direct the demurrage be more precise, the implications are much starker. It is conceivable that financial institutions might make the case that their money (more precisely, money in their accounts) should be insulated from those policy measures, thus creating a corporatist monetary system: consumers and unfavored economic actors wrestling with concocted losses of purchasing power, economic elites, their firms, and other court favorites receiving, or being left with, unimpinged purchasing power. Exactly where the lines between the favored and not are drawn, and the occasions upon which they are invoked, are left to the reader’s imagination. A look at the influence exerted by both special interest groups and corporations on public policy is instructive.

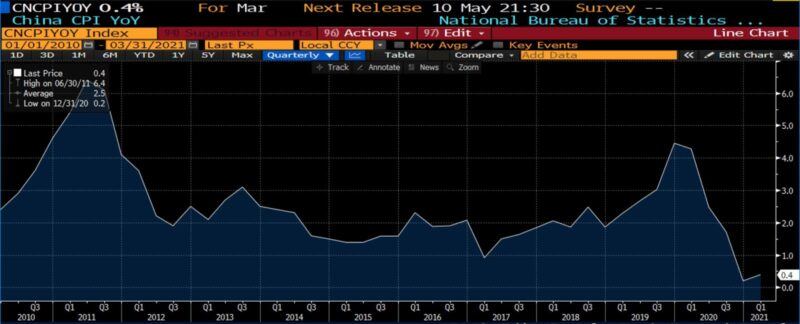

Chinese CPI (YoY, 10 years)

But this only opens the proverbial door. History is rife with examples of political initiatives which, however nobly intended or narrowly designed, became blunt tools of widespread oppression.

Could a demurrage feature of a programmable digital currency, nominally designed to spur consumption and increase monetary velocity, not ultimately become a broad punitive instrument? It could serve as an intermediate form of a fine for misdemeanors or other legal sanctions: Rather than forfeiting a lump sum, a violator’s account balance could be rigged for an accelerated loss of purchasing power. The argument in support of such a measure may well be that it punishes wrongdoers virtuously, afflicting the health of their bank balance whilst “supporting the economy” or “fostering economic growth.”

Although it tempts speculation of a particularly Orwellian tenor, one may imagine––I stress the term imagine as distinct from predict or expect, as this is not a conspiracy theory––the tying of anything from mandatory insurance coverage to getting vaccinated to compulsory voting to be enforceable under the threat of individually-targeted monetary penalties. Whether or not such a measure would fall under the legal category of a Bill of Attainder would also, likely, be a matter of considerable controversy.

A state determining that its populace is insufficiently supportive of a military campaign may decide that hardships are not being sufficiently shared: A sudden, unannounced attack on bank balances resulting in an immediate loss of purchasing power could be imposed to align interests. Could a failure to consume certain goods––say, domestic versus foreign––trigger a government-decreed, disciplinary lopping of an offender’s bank balances? In the same way that a former president allegedly used the Internal Revenue Service to terrorize and harass political opponents, a currently innocuous programmable digital currency may, over time, morph into nothing less than weaponizable money.

China, by launching its digital yuan project, is traversing new territory in the realm of authoritarian monetary planning. Unfortunately, this endeavor may not be an isolated experiment for much longer; already, officials with the U.S. Federal Reserve are engaging in research to build and test a digital dollar. Central bankers the world over, in fact, are signaling increasing openness to experimental policy initiatives. This particular project is still in its infancy, but one thing is certain regardless of differing cultures or political systems: Central banks of all colors are prone to the pitfalls of central planning and will necessarily inflict unintended consequences upon the populations they serve.

Money, in its most basic form, is an irreplaceable facilitator of economic calculation and a social instrument making cooperation possible on a global scale. Policies of the sort which programmable digital currencies bring into the realm of possibility potentially turn those on their head, introducing new possibilities for intentional––and systematic––coercion.

0 Comments