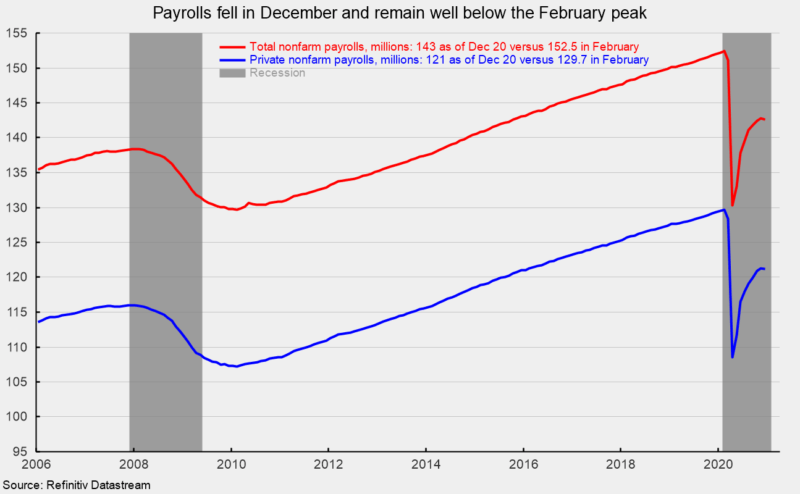

U.S. nonfarm payrolls lost 140,000 jobs in December, the first monthly decline since the historic, shutdown-driven plunges in March and April. The drop follows six monthly gains. The latest decline brings the eight-month post-plunge recovery to 12.32 million and is far from offsetting the 22.16 million loss in March and April (see first chart).

Private payrolls dropped by 95,000 jobs in December, which brings the eight-month recovery to 12.70 million versus a loss of 21.19 million in March and April. Total payrolls remain 9.84 million below the February peak while private payrolls remain 8.50 million below the February peak (see first chart).

However, the details of the report are mixed, with many industries posting gains in payrolls in December. Overall, the report suggests that the industries within the labor market recovery and the broader economy are recovering at widely differing paces and remain heavily impacted by government restrictions on consumers and businesses. The uneven performance of the different industries, the large gaps to full recovery, the surging number of new cases of Covid-19, and new government restrictions being implemented around the country, are all raising doubts about the strength and durability of the recovery.

Within the 95,000 drop in private payrolls, private services lost 188,000 while goods-producing industries gained 93,000. For private service-producing industries, the losses were led by a 498,000 plunge in leisure and hospitality while education lost 31,000. Most other industries posted small gains (see second chart).

Within the 93,000 gain in goods-producing industries, construction added 51,000 jobs, durable-goods manufacturing increased by 23,000, nondurable-goods manufacturing rose by 20,000, and mining and logging industries added 4,000 jobs (see second chart).

However, every private industry group had fewer employees in December than in February. The net losses range from about 8,400 in utilities workers to a devastating 3.9 million in leisure and hospitality (see third chart). Leisure and hospitality is the only private-sector industry to show a 10-month decline of more than 1 million and only professional and business services (down 858,000) and healthcare and social assistance (down 844,000) have declines between 500,000 and 1 million (see third chart).

On a percentage basis, the cumulative declines are more evenly distributed. Leisure and hospitality still leads with a 23 percent drop since February, however, mining and logging comes in second with a 12 percent loss followed by education services at 11.8 percent and information services at 9 percent. Eight of the 14 industries shown in the report have declines of four percent or more since February (see fourth chart).

The government sector cut 45,000 employees in December, with local government payrolls dropping by 32,000, state government payrolls down 19,000, and the federal government adding 6,000 workers.

Average hourly earnings rose 0.8 percent in December, putting the 12-month gain at 5.1 percent. Combining payrolls with hourly earnings and hours worked, the index of aggregate weekly payrolls rose 0.4 percent in December following a 0.7 percent gain in November. The index is still down 0.3 percent from a year ago.

The total number of officially unemployed rose to 10.736 million in December, a rise of 8,000 from November. The number of officially unemployed in February was just 5.717 million.

The unemployment rate was unchanged at 6.7 percent while the underemployed rate, referred to as the U-6 rate, fell from 12.0 percent in November to 11.7 in December; the peak was 22.9 percent in April.

The participation rate was also unchanged in December, holding at 61.5 percent; the participation rate was 63.3 percent in February 2020 and fell to a low of 60.2 in April during the lockdowns. The employment-to-population ratio, one of AIER’s Roughly Coincident indicators came in at 57.4 for December, above the 51.3 ratio in April but still well below the 61.1 ratio from February 2020.

The December jobs report shows that the labor market and the broader economy are posting mixed results with some areas continuing to slowly recover from the massive declines in March and April but other areas suffering setbacks amid rising Covid-19 cases and renewed government restrictions. The longer consumers are restricted and businesses are closed or restricted, the longer the labor market will remain weak and the more likely that financial strains such as debt delinquencies, debt defaults, and bankruptcies will hamper and delay full economic recovery.

0 Comments