“You can see the computer age everywhere but in the productivity statistics.”

Robert Solow (1987) Emeritus Institute Professor of Economics at Massachusetts Institute of Technology (MIT)

According to the IMF – World Economic Outlook – October 2020, global GDP is expected to contract by 4.4% in 2020 and rebound by 5.2% in 2021. Along with the pandemic-related economic contraction of last year, global unemployment rates have soared as hundreds of millions of workers have lost their livelihoods: –

The International Labor Organisation (ILO) Monitor: COVID-19 and the world of work. Sixth edition, published at the end of September, estimated that, compared to Q4 2019, during Q1, 5.4% of global working hours were lost – equivalent to 155mln full-time jobs. By Q2 this number had risen to 17.3% or 495mln jobs. Their Q3 estimate was a more modest 12.3% – still 345mln out of work. The impact this combined supply and demand shock has had on productivity, however, is more difficult to divine.

Total factor productivity (TFP) is a measure of productivity calculated by dividing economy-wide total production by the weighted average of inputs, such as labour and capital. It attempts to calibrate growth in real output (total product) in excess of the growth in inputs (factors of production).

There are two broadly accepted measures of productivity: –

- Labour productivity = total output/units of labour

- TFP = total output/weighted average of the inputs

TFP essentially represents that increase in total production which is in excess of the increase in inputs. It is derived from difficult to calibrate factors such as the rate of adoption of new technology, improvements in education, breakthroughs in research and development and the uptake of enhanced business/production methods.

Writing in April 2020 for VoxEu – The COVID crisis and productivity growth Filippo di Mauro, and Chad Syverson suggested a number of reasons productivity growth would be impaired as a result of the current pandemic, including higher transactions costs, lower mobility and a reduced reallocation of resources across firms, sectors, and countries. The authors did allude to some improvement in productivity stemming from the adoption of new technologies.

By June the World Bank had released the first major assessment of the impact of the pandemic – Global Productivity: Trends, Drivers, and Policies. Running to more than 400 pages, the analysis was comprehensive. The authors put the impact on productivity of the current crisis into historical context, finding that severe disasters typically harm productivity. They noted that countries struck by pandemic outbreaks during the 21st century (excluding Covid) experienced a labour productivity decline of 9% after three years, but expected that the pandemic could also unleash a longer-term technological boost to productivity.

The World Bank reflected on the broad-based decline in productivity growth from a peak of 2.8% in 2007, to a post-financial crisis trough of 1.4% in 2016. In Emerging Market and Developing Economies (EMDEs) the decline was even more pronounced – 6.6% in 2007 to 3.1% in 2015.

The drivers of weakening productivity growth included a deceleration in the working-age population, a stabilisation of educational attainment and, due to the shortening of global value chains, a decline in the pace of expansion of more diverse and complex forms of production. Interestingly, the researchers also identified a new productivity driver: the increasing importance of economic complexity, urbanization and innovation, noting that technology-driven gains tended to displace workers in the short run.

The authors contend that in the current structurally straightened environment the pandemic and associated recession have acted as an accelerant to these declining productivity trends, whilst, looking ahead, they are concerned that, despite (or perhaps because of) historically low interest rates, global debt levels will act as a continued drag on productivity. They anticipate a kind of chain reaction as weaker investment undermines the long-term viability and resilience of operations, leading companies to retreat from global value chains; this in turn will reduce the pace of international technology transmission, further discouraging investment.

The authors also discuss the negative impact Covid has conferred on global education and point to the slowing momentum in the reallocation of labour from low-productivity to higher-productivity sectors. This is a process which has historically accounted for around 40% of EMDE productivity growth.

Amidst the penumbral gloom, the World Bank does see some cause of optimism, however. They allude to productivity-enhancing opportunities from technology, especially for those countries that employ complementary policies in order to seize them. They mention the adoption of greater automation of production, particularly in manufacturing, as well as the benefits to be derived from digital technologies. The authors foresee creative destruction as the least efficient firms are eliminated, together with the creation of more diverse and robust supply chains.

Sadly, with global interest rates near historic lows, the prevalence of zombie corporations bodes ill for any substantive cleansing of the slate, but trends such as supply-chain diversification and near-shoring/reshoring seem set to continue. For more about zombie firms – defined as those firms that are unable to cover debt servicing costs from current profits over an extended period – this 2018 paper from the BIS – The rise of zombie firms: causes and consequences makes sober reading – they estimate that prevalence of zombies among the corporations of the G10 rose from 5% in 2000 to 12% in 2017.

In terms of the policy response, the World Bank recommends the following to increase technological productivity:-

- policies to encourage and support the training and retraining of workers in new technologies

- policies to mitigate the negative effects on transitioning workers

- demand management to maintain full employment

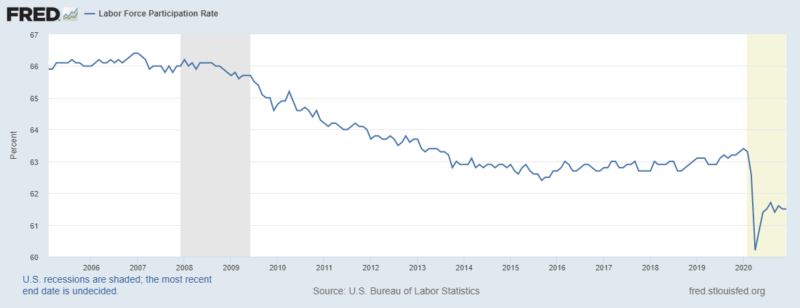

By the time we reached the summer, initial lockdown restrictions had been lifted in several developed countries. It was becoming patently apparent that society and the businesses which support it would never return to pre-2020 normality; the entire world was in a state of flux. The carnage in the global labour market was becoming more clearly defined. It was estimated that as much as one-third of job losses and one-fifth of lost income might be permanent. The damage, however, would be concentrated in certain industries and sectors – travel and entertainment being hardest hit. Minorities and low-skilled workers, as usual, would suffer most. A sustained lack of employment opportunity would lead to another structural decline in the labour participation rate, similar to that which occurred after the great financial crisis in 2008. The chart below shows the US experience to date: –

In this precarious environment capital expenditure was expected to plummet, but, as the chart below reveals, the fiscal and monetary response of the US government and the Federal Reserve (together with other central banks around the world) ensured a rapid recovery in confidence: –

As the World Bank described in their report the crisis accelerated many trends including a reversal of globalization.

One such trend has been the move to remote work. For some of these sectors and industries, productivity has actually increased and for many remote workers total hours worked has risen too, but obstacles have also become evident as key business activities, such as project completions fall behind schedule due to a lack of physical collaboration and the challenge of hiring and training new talent has become apparent.

The OECD picked up on the potential benefits of remote working in their September publication – Productivity gains from teleworking in the post COVID-19 era: How can public policies make it happen? They concluded that telework is here to stay; that its adoption can become more widespread; that it has the potential to improve productivity. However, there is ambiguity as to its societal benefit. Home-working carries risks, especially for long-term innovation and worker satisfaction. To minimise these risks the OECD entreat policy makers to ensure teleworking remains a choice rather than an obligation, going on to advocate the promotion of managerial best practices, together with self-management and ICT skills training. They encourage governments to invest in reliable, high-speed broadband and a widening of corporate support of home office infrastructure.

The rapidly changing nature of work is a perennial theme – this trend is hardly new. Automation and technology will affect a much wider cross-section of workers in the coming decade than it has in the past. The chart below shows those occupations most at risk: –

By November the world had seen the approval of the first vaccines, prompting equity markets to rise precipitously, despite a second wave of infections. The identification of a new Covid mutation with a much higher infection rate, however, has since tempered some of the euphoria of equity bulls.

In the more sober environment of December, the Bank of England published – The impact of Covid-19 on productivity in which they analysed data from the Decision Maker Panel, a monthly panel survey of around 3,000 UK firms. This forward-looking research suggests that TFP in the UK private sector will be reduced by up to 5% in Q4, 2020 and by around 1% in 2022 and beyond.

In the medium-term, the authors’ anticipate a large reduction in research and development expenditure, together with a decline in its efficacy, due to lockdown restriction on movement. They also note that as much as one-third of the time of senior management has been devoted to dealing with the pandemic. As with the impact of the pandemic on education, it may be several years before the longer-term negative impact of the pandemic is fully evident in the diminution of productivity.

Looking beyond the next two to five years, we may, however, be on the brink of a productivity explosion. The Economist – Reasons to be cheerful – picked up on this theme. They postulate three hypotheses to explain the recent dearth of TFP growth: –

- recent innovations are simply not as transformative

- chronically weak demand

- it takes time to work out how to use new technologies effectively

In their January 2020 paper for NBER – The Productivity J-Curve: How Intangibles Complement General Purpose Technologies – Erik Brynjolfsson, Daniel Rock and Chad Syverson argue: –

General purpose technologies (GPTs) such as AI enable and require significant complementary investments, including co-invention of new processes, products, business models and human capital. These complementary investments are often intangible and poorly measured in the national accounts, even when they create valuable assets for the firm. We develop a model that shows how this leads to an underestimation of productivity growth in the early years of a new GPT, and how later, when the benefits of intangible investments are harvested, productivity growth will be overestimated. Our model generates a Productivity J-Curve that can explain the productivity slowdowns often accompanying the advent of GPTs, as well as the increase in productivity later. We use our model to analyze empirically the historical roles of intangibles tied to R&D, software, and computer hardware. We find substantial and ongoing Productivity J-Curve effects for software in particular and computer hardware to a lesser extent. Our adjusted measure TFP is 11.3% higher than official measures at the end of 2004, and 15.9% higher than official measures at the end of 2017.

The opening quotation from Robert Solow was made back in 1987, and the deferred productivity growth to which he alluded finally started to show up in 1996. The answer is 17 years, what is the question: understanding time lags in translational research – published in 2011 by Zoë Slote Morris, Steven Wooding and Jonathan Grant by Journal of the Royal Society of Medicine, suggests the lag between innovation and adoption may take even longer.

The current pandemic has yet to run its course, and the social and economic impact will take much longer to work its way through. Productivity growth, in the medium term, is liable to disappoint, but deferred creative disruption – a deferral which artificially low interest rates have allowed to persist since 2008, if not earlier – could set the stage for an era of dramatic productivity growth in the decades ahead. In fact many of the technologies adopted during the pandemic, such as video conferencing, are far from new; hopefully their adoption will rapidly appear in the productivity data.

0 Comments